Economic Update June 2021

Inflation rears its head

Advanced economies will experience stronger near-term growth as economies re-open and are fuelled by ongoing stimulus. Yet this outsized growth occurs while supply chains remain impeded by pandemic effects, hence a disequilibrium has emerged in the global economy. This has sparked inflation concerns, notably in the US, that have reverberated through markets.

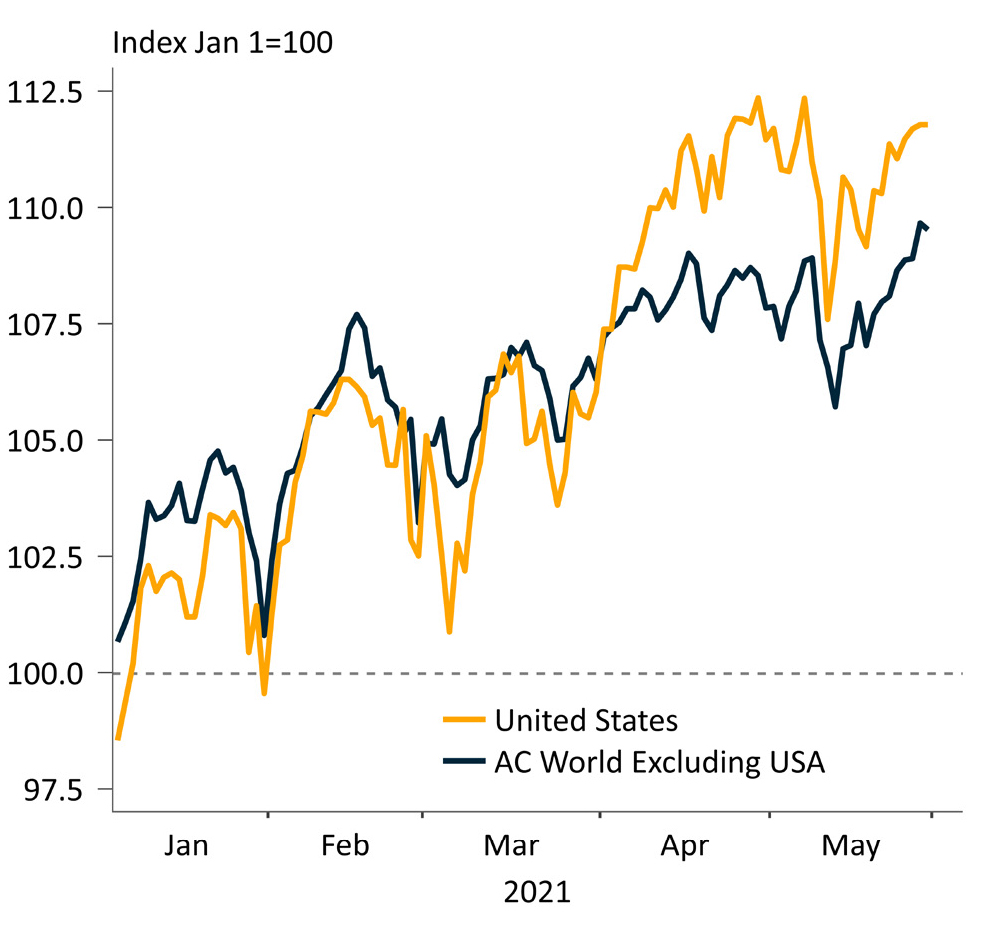

GLOBAL EQUITY MARKETS

Markets lose momentum as inflation emerges

Source: IFM Investors, MSCI, Macrobond as at 2 June 2021

Inflation is clearly the key tail risk for financial market investors at the moment. This has just as much to do with the impact inflation has on equities and other asset classes as it has to do with the fear that the US Federal Reserve, and potentially other central banks, will be forced to respond to it by removing some of the stimulus that has buoyed equity global markets for much of the COVID-recession. Reflation was always coming and has been evident in commodity markets, manufacturing surveys and semi-conductor and producer prices – but now it’s arrived in consumer prices, markets seemingly face an inflection point.

In our view – and that of most central banks – inflationary pressures will likely be transitory, with demand and supply normalising following the recovery phase. This view is reinforced by the fact that most pre-pandemic headwinds to inflation will persist over the medium-term.

Meet the authors

Related articles

Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

Investing in Australia: Accelerating industry super investment and growing Australia’s housing supply