Infrastructure Horizons 2025

Get insight on the forces reshaping the future of infrastructure investing – our latest full report is now available.

Learn moreInfrastructure Horizons 2025: How emerging trends in infrastructure will change the world

Infrastructure investors are looking at new opportunities in growing areas like artificial intelligence, data centres, renewable natural gas, sustainable aviation fuel and the energy transition, as the asset class continues to mature. Read more in our full report.

Learn more about our Infrastructure Equity Asset Portfolio

We target core infrastructure assets that typically have strong market positions, conservative leverage, predictable regulatory environments and high barriers to entry.

Infrastructure learnings

Infrastructure learnings

Infrastructure Equity

6 Learnings from 3 decades

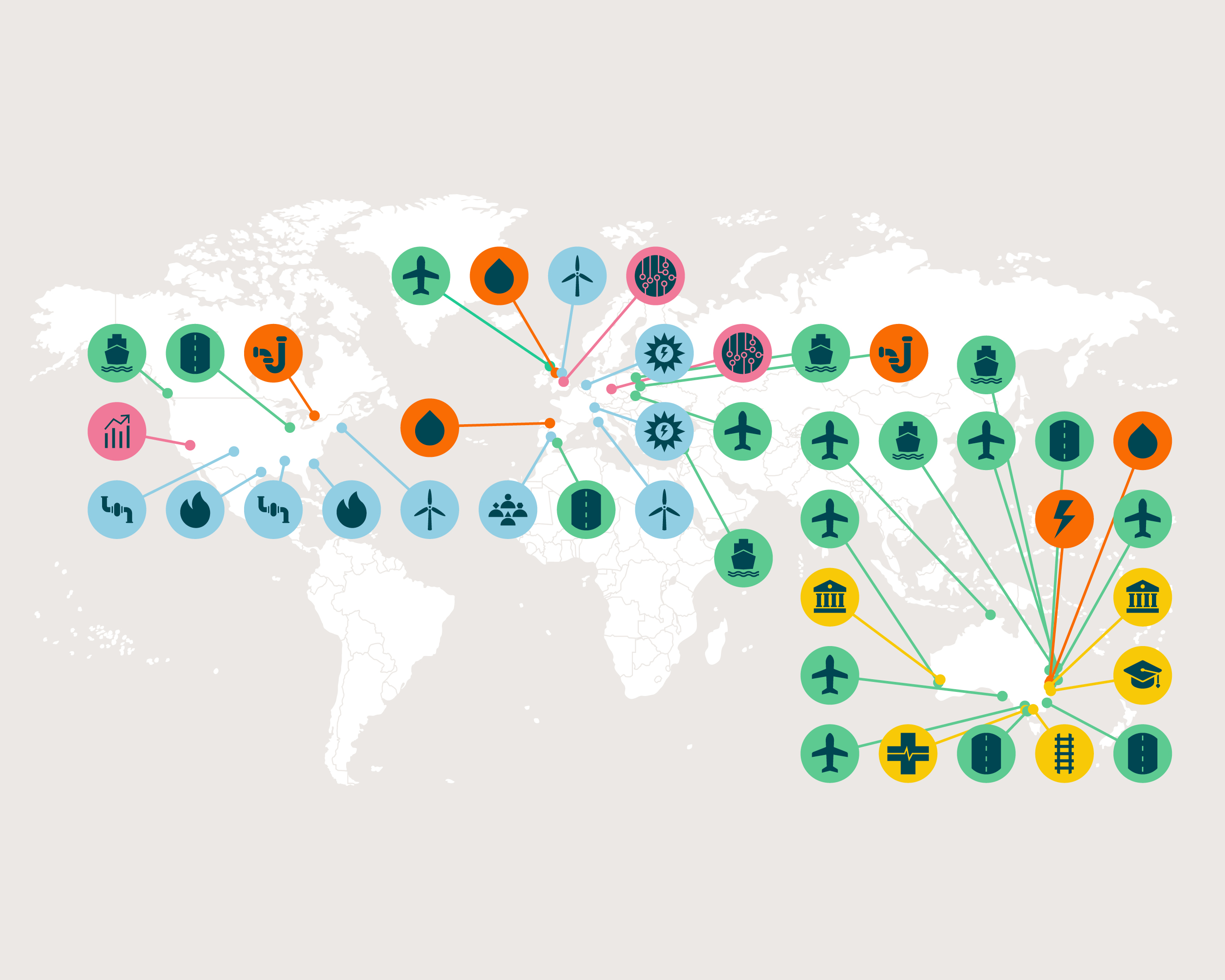

IFM Investors has an established track record in infrastructure, built by a long-term approach to value creation. Today, our portfolios invest in assets that include toll roads, airports, seaports, energy, pipelines, renewables, terminals and digital technology, mainly across North America, Europe and Australia. We strive to buy well and manage assets intensively, aiming to deliver resilient returns.

Here are the 6 lessons we’ve learned as an expert infrastructure equity investor.

Infra Equity - Learning 1

Take a long-term view

We think in decades, not in years or quarters.

The essential infrastructure assets we invest in serve communities and underpin the smooth-running of economies over life spans stretching 50 to 70 years, or more.

Infra Equity - Learning 2

Construct an all-weather portfolio

Our long-term, open-ended fund structure enables us to construct an all-weather portfolio – one which supports revenue stability through varying market and economic conditions.

Infra Equity - Learning 3

Build the right team

From our own global team and advisory network to the teams who run the assets, we look to cultivate a team with a diversity of skills and experience.

We recognise the value of specialist industry expertise and we have developed an extensive group of senior advisors to work with us exclusively.

Infra Equity - Learning 4

Buy well

Buying well is the most critical part of the infrastructure investing equation, as it’s very difficult to recover from a bad buying decision. When considering investment opportunities, we look for a series of distinct characteristics.

Infra Equity - Learning 5

Take a conservative approach to leverage

As a long-term investor investing through open-ended funds, we aim for capital structures that are resilient to market cycles. We focus on our assets issuing long-dated, fixed-rate debt while maintaining investment grade credit ratings.

Infra Equity - Learning 6

Create long-term value through active management

Infrastructure is not a set and forget asset class. So actively managing our assets is one of our most important tools for maximising long-term returns to our clients. Our asset management initiatives range from capex programs, financing, M&A, safety reviews, mitigating climate change risk, and cyber security.

Infra Debt - Introduction

Lending to essential infrastructure

Infrastructure debt can fit into a variety of portfolio allocations. By allocating to infrastructure debt, investors can seek exposure to assets essential for the functioning of society – assets often able to perform regardless of the economic cycle.

Whether lending to toll roads, power plants or port facilities, these are assets that are often the sole provider of a service to a community.

Infra Debt - Learning 1

Essential assets can provide market cycle resilience

We lend to assets essential for the functioning of society – assets often able to perform regardless of the economic cycle. Whether lending to toll roads, power plants or port facilities, these are assets that are often the sole provider of a service to a community.

Infra Debt - Learning 2

A valuable role in portfolio construction

Infrastructure debt can fit into a variety of portfolio allocations - primarily private credit or real asset allocations. From a private credit perspective, it fits in well with the portfolio because it acts as a ballast.

The asset class can potentially perform through economic cycles, and dampen the volatility that an investor may see in their broader corporate portfolio due to the economic cycle.

Infra Debt - Learning 3

Experience helps to identify relative value

The investment team at IFM Investors has decades of experience in the infrastructure debt market. Our experience means we have seen that technology changes that occur within the broader society drive changes within the infrastructure world.

Our experience allows us to chart how the market has evolved, to understand where the opportunity set is and have an understanding of emerging trends.

Infra Debt - Learning 4

Potential value across the lifecycle

At IFM Investors, we have structured our platform to provide access to infrastructure debt that can add value across the lifecycle – and across investment grade debt, sub investment grade debt, mezzanine debt, and across a broad range of credit profiles.

Infra Debt - Learning 5

Looking for value outside mainstream renewables

The energy transition is a hot topic. Across mainstream markets, investors are focused on wind and solar, but we believe an additional opportunity set is looking beyond those traditional renewable asset classes to opportunities needed in 10 or 15 years.

Infra Debt - Learning 6

Leveraging 3 decades of infrastructure knowledge

IFM Investors is a unique organisation, almost exclusively focused globally on infrastructure, across debt and equity, with nearly 30 years of experience in the market.

Scroll for more

Explore our capabilities

Infrastructure

How we manage our investments in infrastructure has been shaped by decades of experience.

Debt Investments

We offer a range of credit, bond and cash strategies for institutional investors.

Responsible investment

We integrate responsible investment principles into our investment processes and stewardship activities.

Contact us

IFM Investors is a global, investor-owned asset manager driven to make a positive difference. We operate from 12 offices, with dedicated Client Solutions teams in cities around the world.