Economic Update September 2020

In the eye of the economic storm

The scale of the initial economic shock caused by the COVID-19 crisis has become clear with the release of the June quarter GDP data across the globe. Many countries have suffered the steepest fall in output since official records began, almost all are in recession and the path to recovery is anything but certain. There has been a worrying resurgence in COVID-19 cases in several countries, following a tentative easing of restrictions, which poses significant downside risks to the outlook. Accordingly, fiscal and monetary stimulus will likely need to remain in place for much longer than initially expected.

In Australia, Q2 real GDP fell 7.0%qoq. This was weaker than expected and the worst result in the history of the modern national accounts since 1959. But it was still better than most advanced economies at this stage of the pandemic, where the median decline was 9.7%qoq.

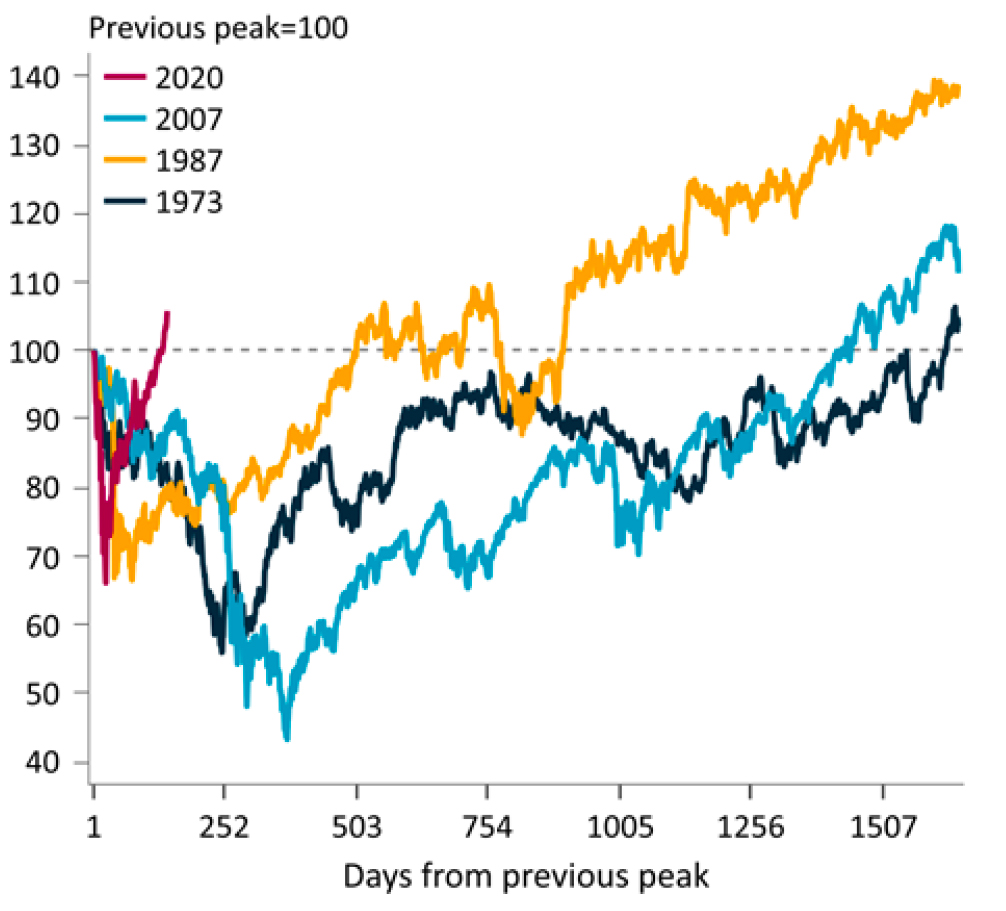

US S&P500 Bear Market Recoveries

Sources: IFM Investors, Bloomberg. Document finalized on September 3rd

Despite the still sobering economic environment, global equity markets have made a strong recovery, buoyed by aggressive stimulus measures. In the US, equities have recorded the most rapid recovery from a bear market in living memory. This largely reflects the tailwind of extreme global monetary stimulus, unprecedented fiscal stimulus and exuberance from investors who are looking through bad news to embrace the good.

Meet the authors

Related articles

インフラ投資の未来展望2025:インフラ市場における新たなトレンドは世界をどう変えるか

Investing in Australia: Accelerating industry super investment and growing Australia’s housing supply