ESG Integration, the cornerstone of IFM's responsible investment and stewardship approach

IFM Investors has been focusing on integrating ESG considerations into investment decisions and ongoing asset management activities for well over a decade. We do this because it adds an additional layer of risk and opportunity assessment that we believe can enhance the long-term financial performance of our investments.

In practice, ESG integration means we systematically and explicitly consider ESG data alongside financial data to shape our decisions throughout the investment process. We also seek to embed ESG considerations in our stewardship activities. We aim to take an active role in influencing the behaviour of investee companies through ongoing dialogue and exercising our voting rights to influence positive change, with the aim of enhancing the long-term net performance and market reputation of investee companies.

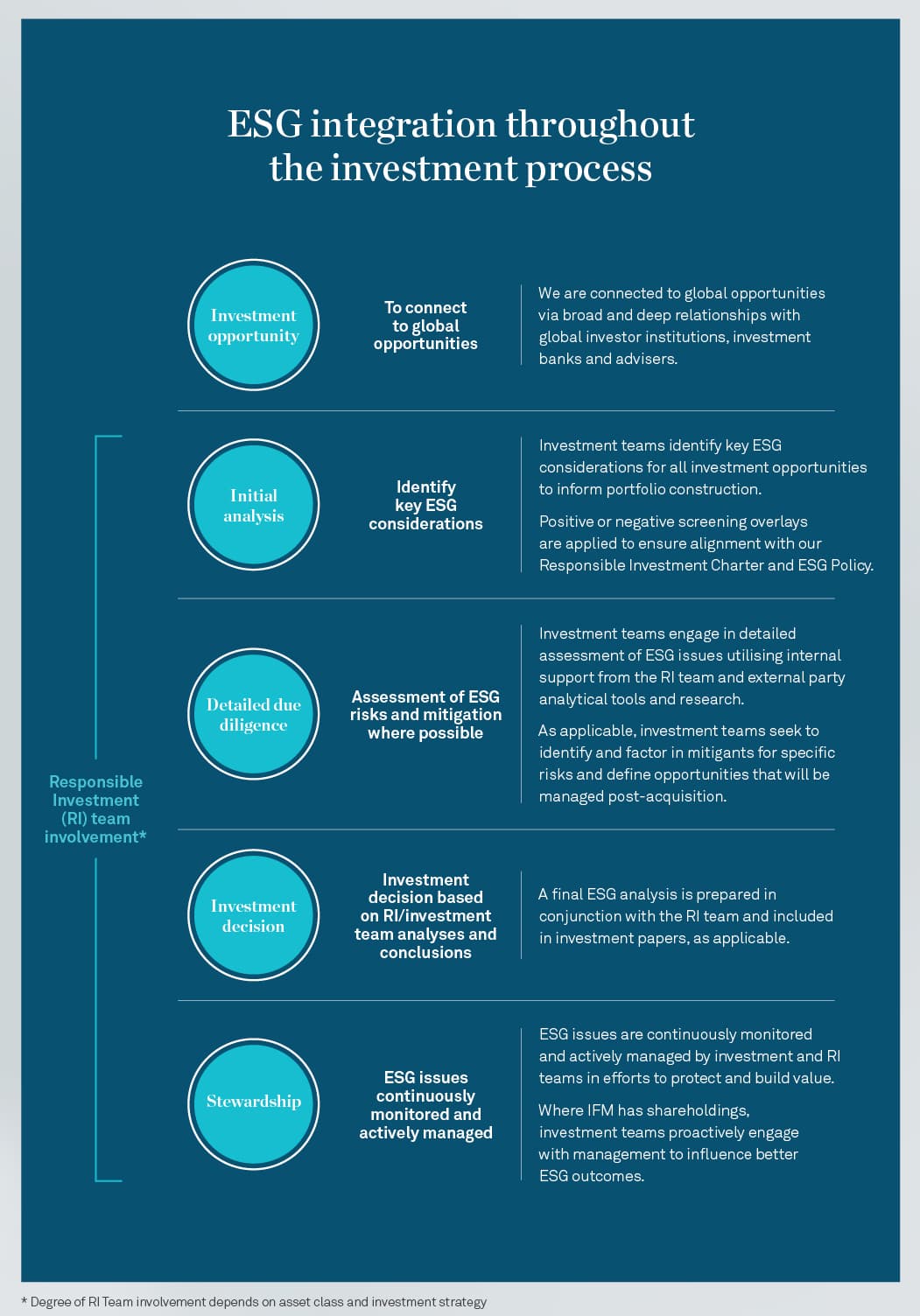

While investment teams across each of our asset classes currently tailor their ESG integration practices to their specific strategies, a high level overview of our approach is illustrated below.

All IFM investment teams work closely with the Responsible Investment team throughout the investment process. This helps to ensure our practices align to our Responsible Investment Charter and ESG Policy and continue to evolve over time, as we focus on protecting and growing long-term investment value and returns on behalf of our investors and their members and beneficiaries.

Related articles

Economic Update June 2025

IFM’s Australian operation secures Family Inclusive Workplace certification