We believe infrastructure debt offers distinct advantages in today’s market, combining resilience, structural diversification, and alignment with global megatrends. Unlike more cyclical areas of private credit, it is also backed by essential assets and supported by generally stable, often contracted cash flows. The points below highlight why we believe infrastructure debt is a compelling opportunity for long-term investors.

1. Resilience

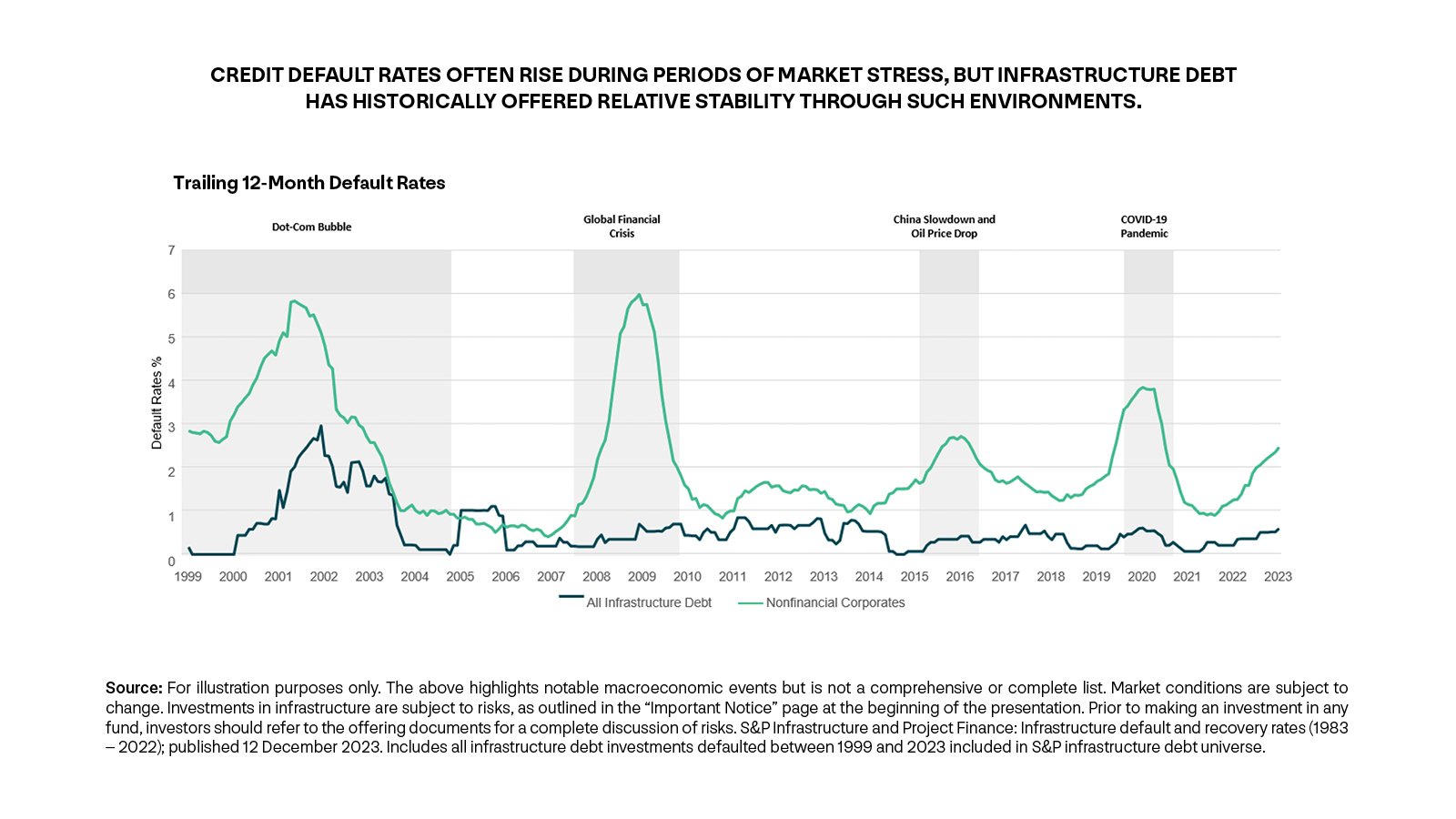

Historically, infrastructure debt has offered resilience through economic cycles, as it is generally backed by essential assets with stable, inelastic demand for their services. We believe these assets will generate consistent cash flows and can pass through inflationary costs—contributing to default rates that are potentially lower than corporate credit.

2. Diversified investment opportunity

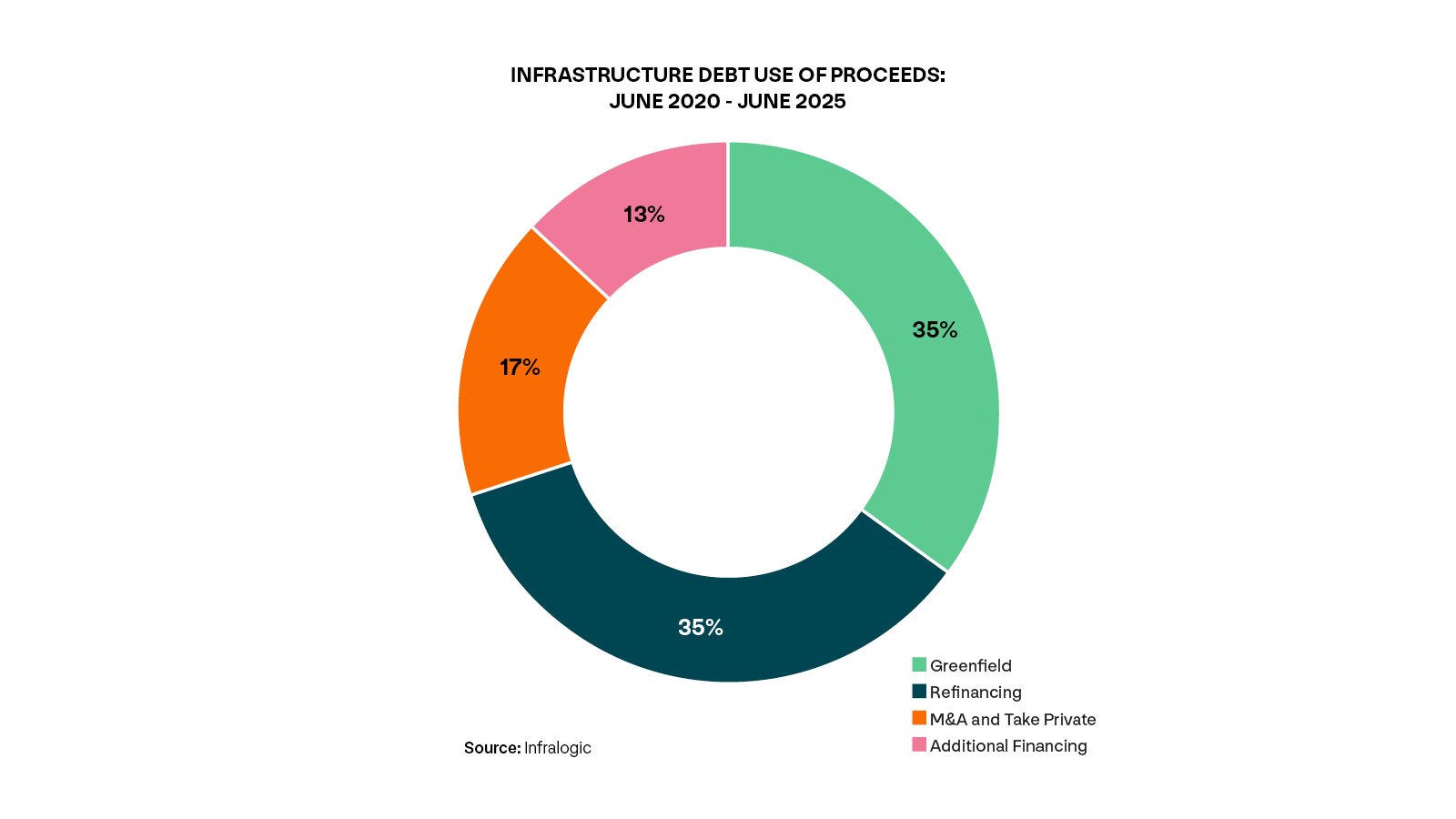

In recent years, between 60–90% of direct lending deals have been tied to M&A activity, making supply vulnerable when deal flow slows—resulting in dry powder buildup, tighter pricing, and weaker credit standards.

In contrast, infrastructure debt generally supports a wider range of financing needs— such as project finance and capital expenditure programs. It also requires complex underwriting, which creates a more specialized and less efficient market. We believe this dynamic presents more consistent opportunities to capture risk adjusted relative value.

3. Secular tailwinds driving demand

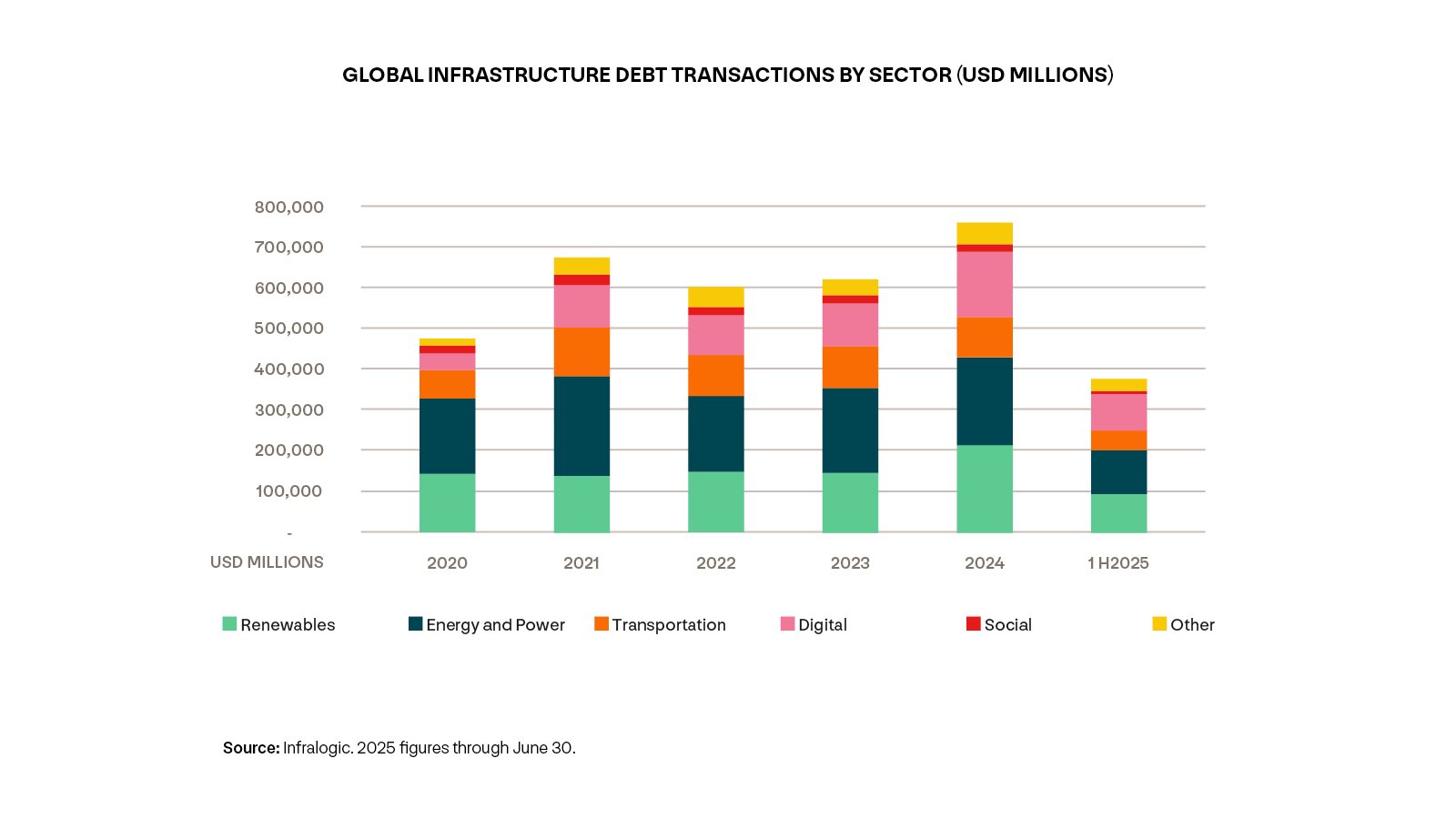

The energy transition, digitalization, growth of AI, and drive for energy independence are reshaping the global infrastructure landscape. Given the significant capex needs, there is an accelerating demand for private capital to fund these growing trends. We expect these trends to present lending opportunities in infrastructure over the long-term.

Meet the author

Related articles

Batteries in the energy transition

Value add infrastructure: Moving up the curve in an era of expanding possibilities

Economic Update December 2025

Disclaimer

The following disclosure applies to this material and any information provided regarding the information contained in this material. By accepting this material, you agree to be bound by the following terms and conditions. The material does not constitute an offer, invitation, solicitation, or recommendation in relation to the subscription, purchase, or sale of securities in any jurisdiction and neither this material nor anything in it will form the basis of any contract or commitment. IFM Investors (defined as IFM Investors Pty Ltd and its affiliates) will have no liability, contingent or otherwise, to any user of this material or to third-parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance, or completeness of the information in this material. In no event will IFM Investors be liable for any special, indirect, incidental, or consequential damages which may be incurred or experienced on account of a reader using or relying on the information in this material even if it has been advised of the possibility of such damages.

Certain statements in this material may constitute “forward looking statements” or “forecasts”. Words such as “expects,”“anticipates,” “plans,” “believes,” “scheduled,” “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements, which include but are not limited to projections of earnings, performance, and cash flows. These statements involve subjective judgement and analysis and reflect IFM Investors’ expectations and are subject to significant uncertainties, risks, and contingencies outside the control of IFM Investors which may cause actual results to vary materially from those expressed or implied by these forward-looking statements. All forward-looking statements speak only as of the date of this material or, in the case of any document incorporated by reference, the date of that document. All subsequent written and oral forward-looking statements attributable to IFM Investors or any person acting on its behalf are qualified by the cautionary statements in this section. Readers are cautioned not to rely on such forward-looking statements. The achievement of any or all goals of any investment that may be described in this material is not guaranteed. Past performance does not guarantee future results. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur. This material may contain information provided by third parties for general reference or interest. While such third-party sources are believed to be reliable, IFM Investors does not assume any responsibility for the accuracy or completeness of such information.This material does not constitute investment, legal, accounting, regulatory, taxation or other advice and it does not consider your investment objectives or legal, accounting, regulatory, taxation or financial situation or particular needs. You are solely responsible for forming your own opinions and conclusions on such matters and for making your own independent assessment of the information in this material. Tax treatment depends on your individual circumstances and may be subject to change in the future.

Australia Disclosure

This material is provided to you on the basis that you warrant that you are a “wholesale client” or a “sophisticated investor” or a “professional investor” (each as defined in the Corporations Act 2001 (Cth)) to whom a product disclosure statement is not required to be given under Chapter 6D or Part 7.9 of the Corporations Act 2001 (Cth). IFM Investors Pty Ltd, ABN 67 107 247 727, AFS

Licence No. 284404.

Netherlands Disclosure

This material is provided to you on the basis that you warrant that you are a Professional Investor (professionele belegger) within the meaning of Section 1:1 of the Dutch Financial Supervision Act (Wet op het financieel toezicht). This material is not intended for and should not be relied on by any other person. IFM Investors (Netherlands) B.V. shall have no liability, contingent or otherwise, to any user of this material or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance, or completeness of this material.

United Kingdom Disclosure

This material is provided to you on the basis that you warrant that you fall within one or more of the exemptions in the Financial Services and Markets Act 2000 (“FSMA”) [(Financial Promotion) Order 2005] [(Promotion of Collective Investment Schemes (Exemptions) Order 2001, or are a Professional Client for the purposes of FCA rules] and as a consequence the restrictions on communication of “financial promotions” under FSMA and FCA rules do not apply to a communication made to you. IFM Investors (UK) Ltd shall have no liability, contingent or otherwise, to any user of this material or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance, or completeness of the information in this material.

Switzerland Disclosure

This Information is provided to you on the basis that you warrant you are (i) a professional client or an institutional client pursuant to the Swiss Federal Financial Services Act of 15 June 2018 (“FinSA”) and (ii) a qualified investor pursuant the Swiss Federal Act on Collective Investment Schemes of 23 June 2006 (“CISA”), for each of (i) and (ii) excluding high-net-worth individuals or private investment structures established for such high-net worth individuals (without professional treasury operations) that have opted out of customer protection under the FinSA and that have elected to be treated as professional clients and qualified investors under the FinSA and the CISA, respectively.