Infrastructure knowledge hub

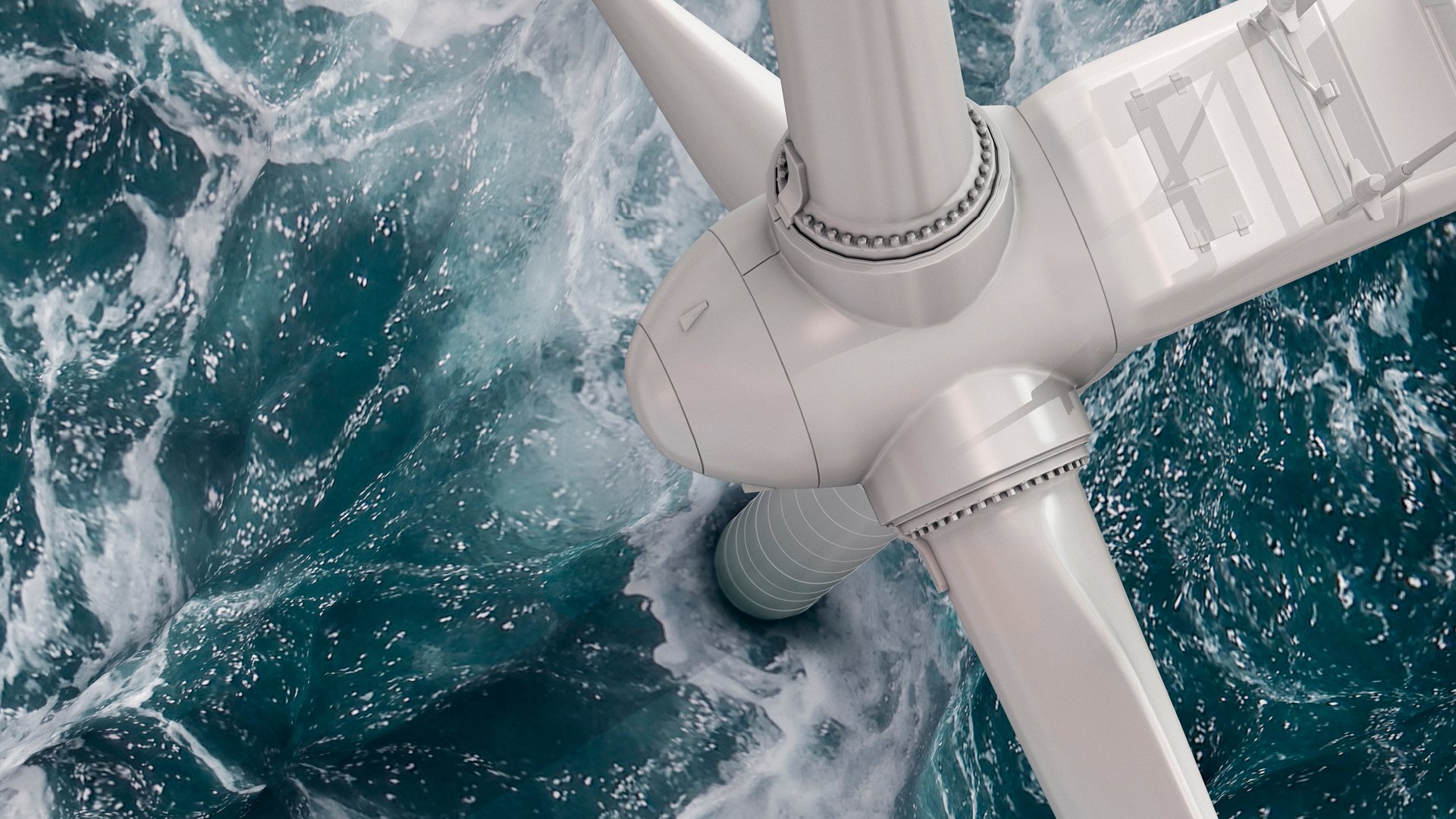

Infrastructure is increasingly on investors’ minds. Our 2025 Infrastructure Horizons report comes as investors are looking at new opportunities in growing areas like artificial intelligence, data centres, renewable natural gas, sustainable aviation fuel and the energy transition, as the asset class continues to mature. Read more in our full report on our Infrastructure knowledge hub.

Sustainable investing

As an institutional investor, we have a fiduciary duty to maximise returns over the long term for the benefit of our investors.

We also recognise that we have a role to play in supporting the broader environmental, social and economic systems that we depend upon for our portfolios to prosper.

Our sustainable investing approach is closely aligned with the United Nations Global Compact and the United Nations-supported Principles for Responsible Investment, to which IFM has been a signatory since 2008.* We integrate sustainable investing principles into our investment processes and active ownership activities by engaging with portfolio companies, policy makers and working with other institutions to bring about positive change.

* The Principles for Responsible Investment is a United Nations-supported international network of asset managers, asset owners and service providers working together to promote and implement six aspirational ESG principles. The PRI’s annual assessment process scores and benchmarks signatories’ responsible investment governance and processes against its principles and other signatories.

Learn about latest insights in institutional investment management, and forward-thinking perspectives from our industry experts.

Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

2024 Annual Sustainability Report

Mobilising pension capital for net zero: a policy blueprint for the UK

Invest in what matters.

More than 25 years ago, IFM Investors was conceived and created by a collective of industry superannuation funds. Today, we are a global institutional asset manager, working to create a better future for working people.