We believe infrastructure debt offers distinct advantages in today’s market, combining resilience, structural diversification, and alignment with global megatrends. Unlike more cyclical areas of private credit, it is also backed by essential assets and supported by generally stable, often contracted cash flows. The points below highlight why we believe infrastructure debt is a compelling opportunity for long-term investors.

1. Resilience

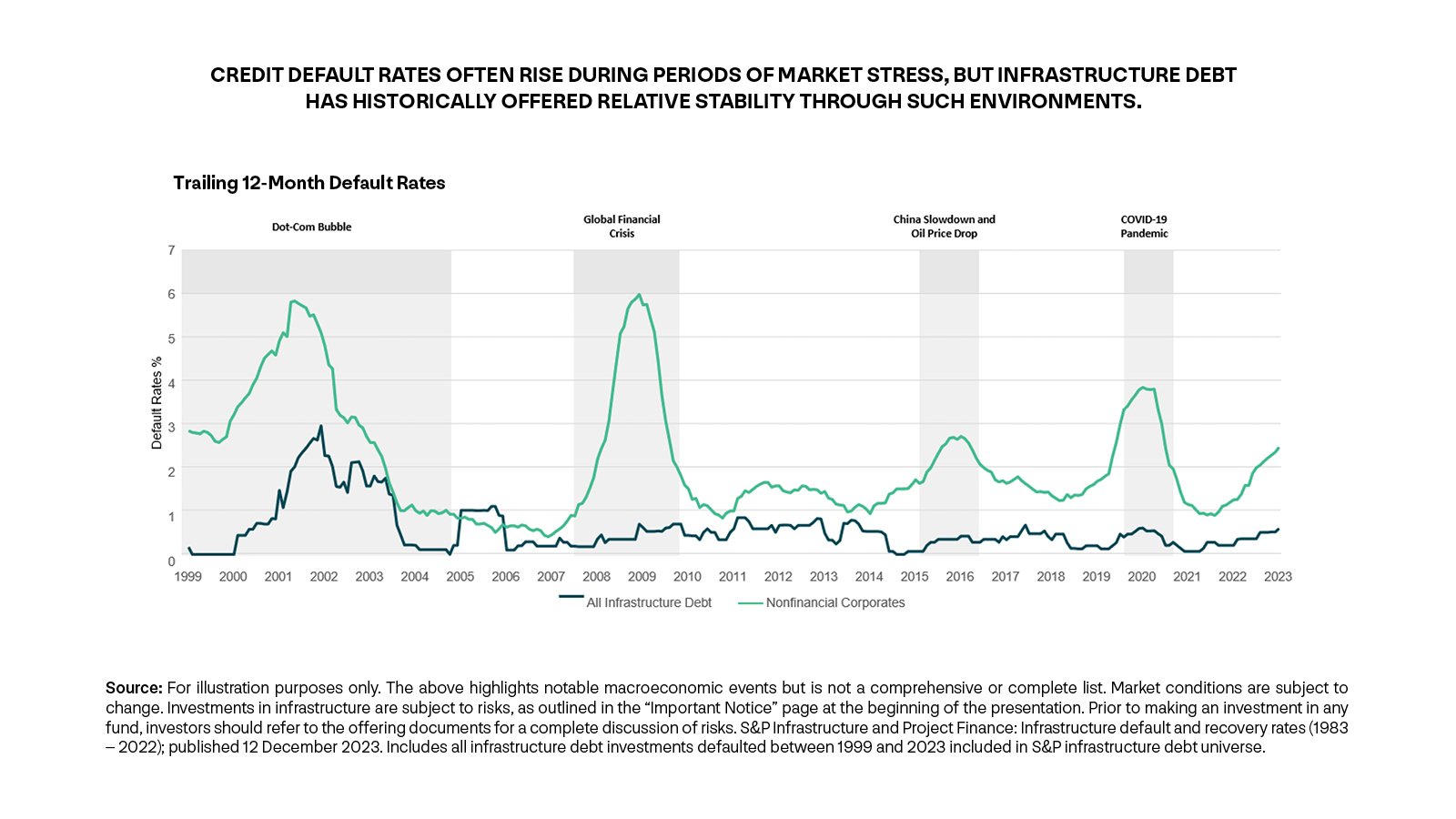

Historically, infrastructure debt has offered resilience through economic cycles, as it is generally backed by essential assets with stable, inelastic demand for their services. We believe these assets will generate consistent cash flows and can pass through inflationary costs—contributing to default rates that are potentially lower than corporate credit.

2. Diversified investment opportunity

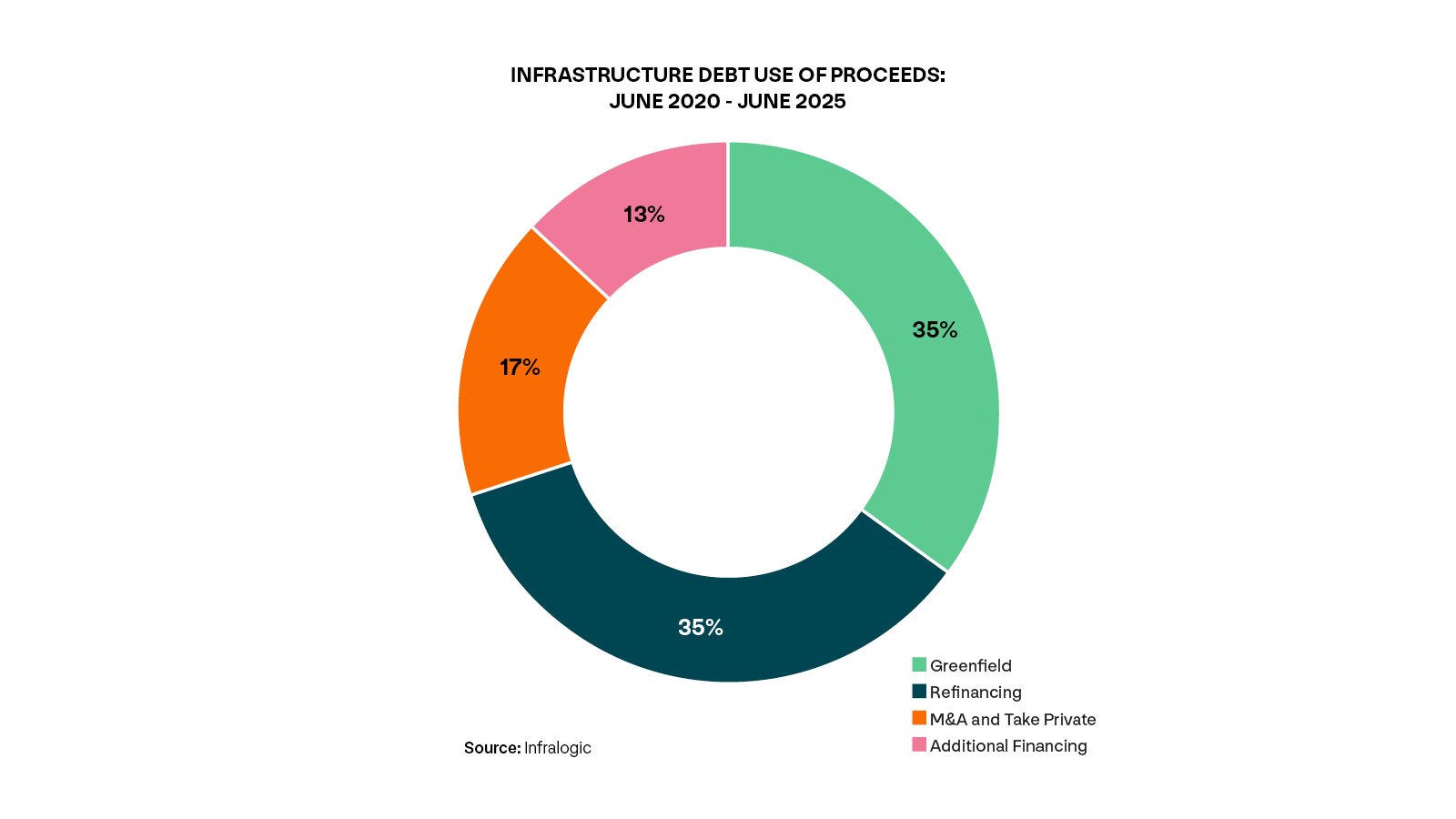

In recent years, between 60–90% of direct lending deals have been tied to M&A activity, making supply vulnerable when deal flow slows—resulting in dry powder buildup, tighter pricing, and weaker credit standards.

In contrast, infrastructure debt generally supports a wider range of financing needs— such as project finance and capital expenditure programs. It also requires complex underwriting, which creates a more specialized and less efficient market. We believe this dynamic presents more consistent opportunities to capture risk adjusted relative value.

3. Secular tailwinds driving demand

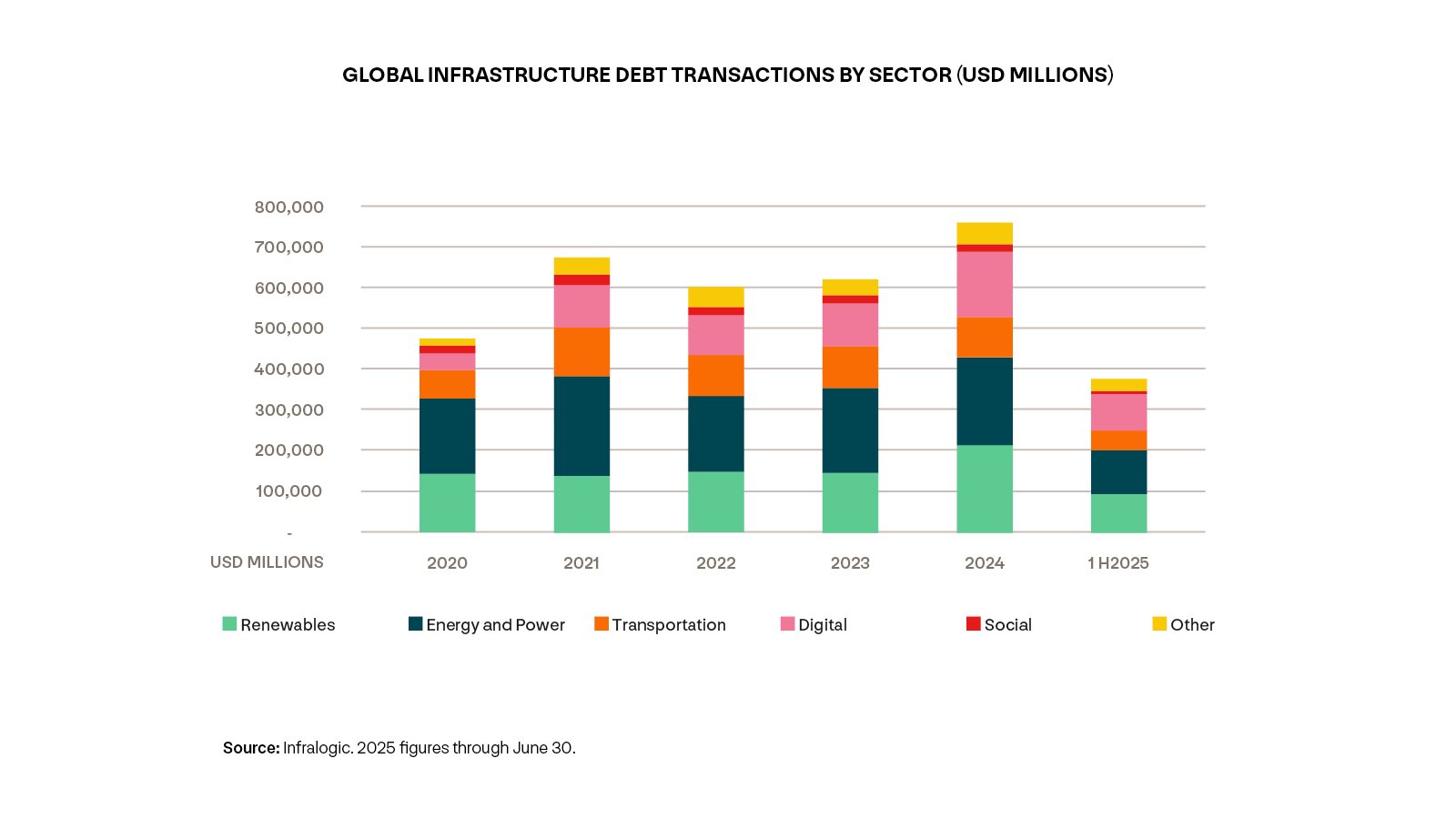

The energy transition, digitalization, growth of AI, and drive for energy independence are reshaping the global infrastructure landscape. Given the significant capex needs, there is an accelerating demand for private capital to fund these growing trends. We expect these trends to present lending opportunities in infrastructure over the long-term.

Meet the author

Related articles

Batteries in the energy transition

Value add infrastructure: Moving up the curve in an era of expanding possibilities