Why infrastructure debt?

For many investors, infrastructure debt strategies can act as a strong diversifier within a broader private credit or real assets allocation and strengthen portfolio performance by virtue of relatively lower defaults and yield premiums to alternative forms of credit.

We manage capital that has the flexibility to invest across the credit spectrum and capital stack, on a global basis.

Through our global network of infrastructure debt specialists, our philosophy is to focus on net returns with the aim of achieving attractive relative value, given our view of the global opportunity set.

Lending to assets that deliver essential services

We invest in opportunities across both investment and sub-investment grade markets through both senior and junior positions.

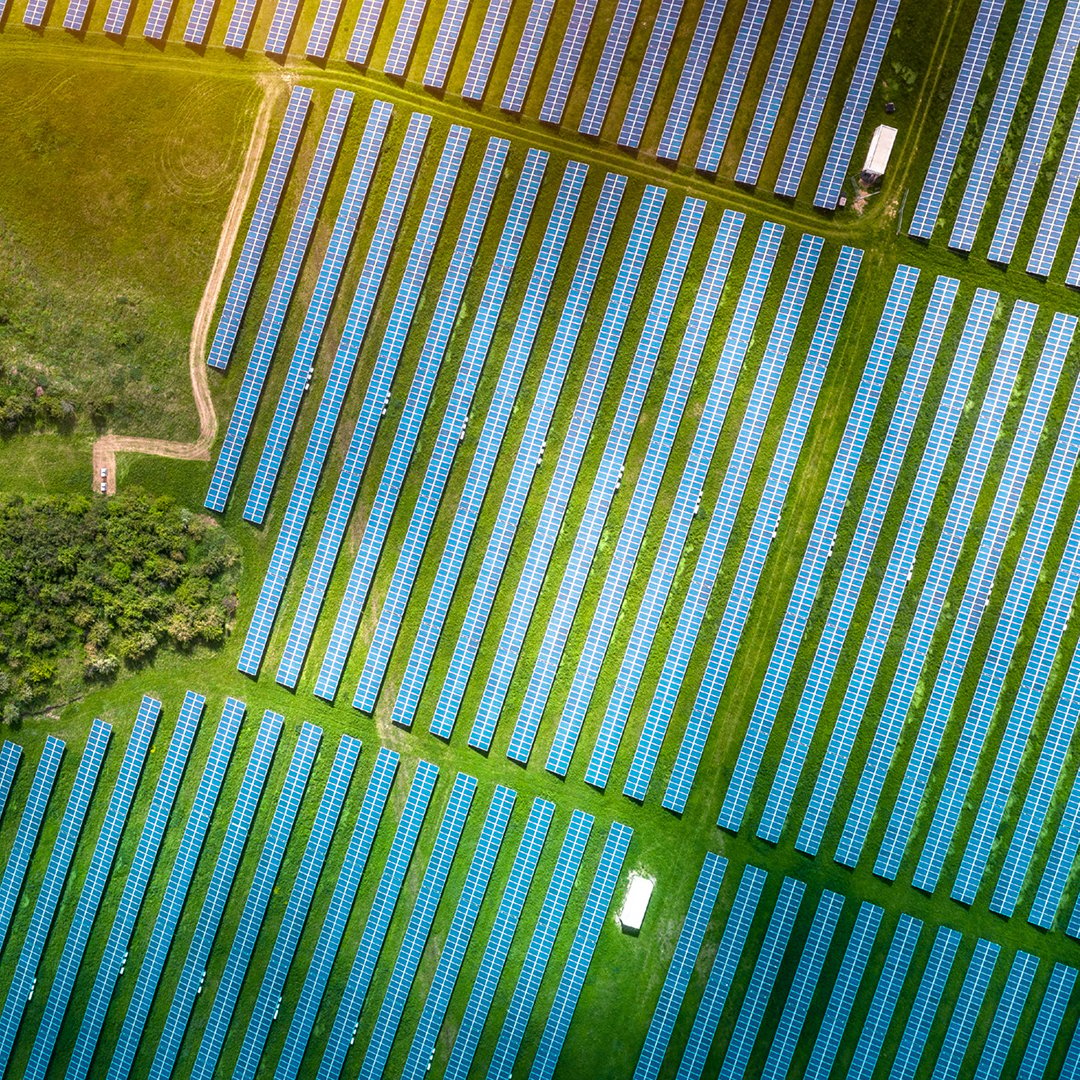

Focused on lending to assets that provide essential services to businesses and individuals, we target long-term visibility on earnings and cashflow. We also seek to originate investments with resilient financing structures, with appropriate levels of leverage, covenants, and strong recovery prospects stemming from long-life tangible assets.

In focus – Global Infrastructure Debt

Our investments aim to deliver stable income and return of capital by investing in infrastructure assets that support the transition to a lower carbon economy and environmental sustainability.

Key features of this approach include:

- Sub-investment grade focus investing in both senior and junior positions

- Seeking attractive relative value on a global basis with a focus on Europe

- Diverse sector and sustainability theme exposure, including energy transition, electrification of transport, environmental management, energy efficiency and digital inclusion.

- Investment framework that aligns with EU SFDR Article 8

- Mostly floating rate exposure in current market environment of inflation and potential for rising interest rates.