Finding attractive relative value in sub-investment grade infrastructure debt

Many investors seek to mitigate the business and financial risks associated with infrastructure debt by primarily targeting the investment grade segment of the market. Such instruments are deemed to have a low risk of credit default by rating agency methodologies. This includes debt rated BBB- or higher by Standard & Poor’s and Fitch, or Baa3 or higher by Moody’s. Returns in this part of the market are resilient, but they are also constrained by the relatively low level of risk that investors are assuming.

Meet the authors

Related articles

Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

Investing in Australia: Accelerating industry super investment and growing Australia’s housing supply

2024 Annual Sustainability Report

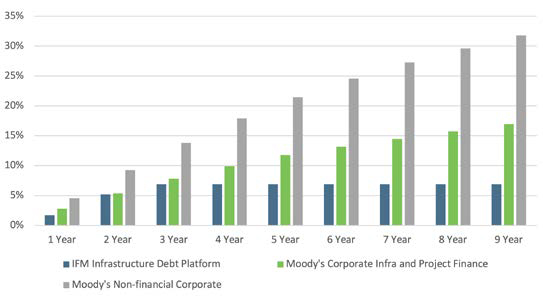

FIGURE 01: SUB-INVESTMENT GRADE CUMULATIVE DEFAULT RATES. Source: Moody’s and IFM Investors

FIGURE 01: SUB-INVESTMENT GRADE CUMULATIVE DEFAULT RATES

We believe it is possible to generate higher returns by investing in sub-investment grade infrastructure debt where credit spreads on offer in the current market environment typically range between 400-600bps. We believe this represents good risk-adjusted value if the higher credit risk is well understood and appropriately balanced when both business risks and financing structures are taken into consideration.

In this paper, we outline our approach to investing in sub-investment grade infrastructure debt and illustrate the process with case studies that highlight the strength of our due diligence process and our ability to assess and trade-off the multiple risk factors associated with each transaction.