Industry trends: 2050, 2030 or today - decarbonising existing infrastructure portfolios

Multiple disruptions are shaping the infrastructure sector, including the global net zero focus, funding shifts driven in part by government stimulus packages and digital transformation. In our Infrastructure Outlook report, we highlight some of the areas that we believe investors will hear a lot about. This article details one of those areas – the focus on decarbonising existing infrastructure portfolios.

With hundreds of the world’s largest businesses and more than 130 countries setting net zero or carbon neutrality policies1, emissions targets are creating challenges and opportunities for infrastructure investors. The targets, together with government policy, may intensify pressure on investors to decarbonise their portfolios and create opportunities to invest in new infrastructure.

Supply-side opportunities

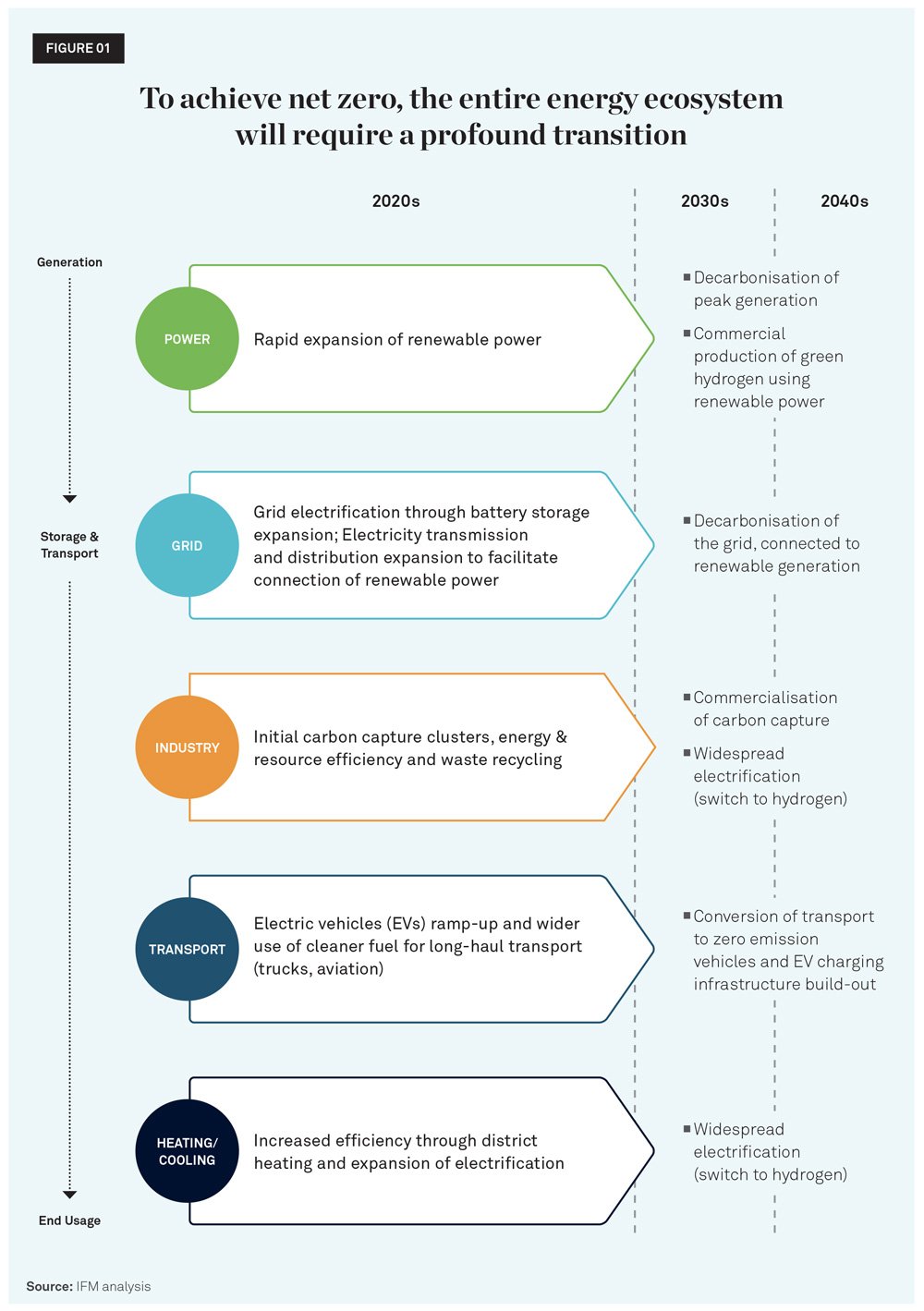

To achieve net zero, the entire energy ecosystem will need to undergo a profound transition (see Figure 1), which will require unprecedented levels of new investment in infrastructure. This will require meticulous planning, especially in ensuring energy certainty, and tackling intermittency issues through the continued evolution in the use of transition fuels, batteries and other technologies.

In its Net Zero by 2050 scenario, the International Energy Agency says that by 2030 close to US$4 trillion will be needed annually for clean energy infrastructure and projects2. While governments are committing increasing amounts to sustainable infrastructure to reach the level of investment required, IFM believes the private sector has a long-term role to play.

Today, the green infrastructure universe is mainly renewables and the transmission lines required to connect energy supply to meet demand. IFM believes this infrastructure is a critical pillar and the foundation to achieving a net-zero economy. As demand for these types of assets has risen, the supply of assets and investment opportunities has also seen a notable increase, and is likely to grow further as more countries commit to ambitious emission reduction targets. Moreover, the market is evolving quickly and the energy transition opportunity set is expected to continue to expand beyond renewables.

The opportunities IFM sees emerging include:

-

an increasing take up of low carbon fuels (such as biofuels and hydrogen)

-

infrastructure investments that support electrification (including creation of grids to accelerate connection to offshore wind and electric vehicle charging stations); and

-

selected carbon capture and storage facilities.

Competitive asset acquisitions are not the only way to participate in the new project supply, with platform models becoming an increasingly common strategy to generate alpha and potentially achieve higher returns than typical standalone financial investments.

Transitioning assets rather than divestment

According to some estimates, half of the global infrastructure of 2050 is already built, under construction or being planned3, implying that active transition strategies will be necessary to meet carbon reduction targets. IFM believes that the role of existing infrastructure in a net zero world is significantly understated. There are, and we expect will continue to be, attractive investment opportunities in transitioning infrastructure assets designed to potentially generate long-term investment returns. Asset divestment forgoes these long-term investment opportunities and, by not addressing the problem, does not achieve the emissions reductions that are possible through responsible asset stewardship.

Although a necessary task, transitioning infrastructure assets to a net zero economy is complex and challenging. Decarbonisation pathways are likely to be different for each asset and will depend on many factors, including: the source of the emissions; the level of control the asset has over the emissions; the commercial viability of existing abatement options; technological advances; and the prevailing policy and regulatory environment.

Nevertheless, we see real opportunity in repurposing traditional infrastructure for alternative uses in the long-term, and leveraging the extensive operational experience and expertise within those companies to diversify and transform their respective business models. Assets such as seaports and airports may also play a key role by constructing supporting infrastructure that facilitates the transition in hard-to-abate sectors, including global shipping, heavy industry and long-haul aviation.

Steps towards transition

Veolia Energia Polska (VEP), heating and steam company, UK/Europe has converted coal units to biomass in the cities of Łódz´ and Poznan´. The conversion has resulted in an annual 10 – 12% emissions reduction for the company, equivalent to 350,000 – 400,000 metric tonnes of carbon emissions a year.

NSW Ports (Port Kembla), seaport, Australia has signed an agreement with Squadron Energy to construct Australia’s first LNG import terminal at the port, which will help meet the state’s gas needs. As part of the energy transition, with a massive increase in the take-up of renewable energy across the state, significant coal generation retirements are expected. Further discussions are underway with the NSW Government to construct a gas-hydrogen co-fired power station at the port.

Melbourne Airport, Australia has completed a 12-megawatt (MW) solar farm on 19 hectares (47 acres) of airport land. This is the largest behind-the-meter solar farm at any Australian airport, and is expected to generate up to 15% of the airport’s annual electricity consumption – enough to power all four passenger terminals.

Net zero infrastructure is one of the four key trends and disruptions shaping we identified as shaping the sector in our Infrastructure Outlook. Check out the full report.

2 www.iea.org/reports/world-energy-outlook-2021/executive-summary

3 www.gihub.org/articles/net-zero-infrastructure/

This article is Part One of a four-part series of excerpts from our Infrastructure Outlook Report, which highlights some of the areas we believe investors will hear a lot about. This article details one of those areas – the focus on decarbonising existing infrastructure portfolios.

Related articles

Economic Update June 2025

IFM’s Australian operation secures Family Inclusive Workplace certification