The ESG Trends on IFM Investors’ Radar in 2019

The ESG trends on IFM Investors’ radar in 2019 fall into the key thematic areas of Planet, People and Policy & Process, reflecting what is important to IFM Investors and our investors.

Investments managed under a ‘sustainable’, ‘ethical’ or ‘responsible’ investment umbrella have moved into the mainstream investment arena and enjoyed significant attention over the past decade. Consumers, working people, communities and governments increasingly expect investors to allocate capital in a socially and environmentally responsible and ethical way. It is our view that these expectations, together with those of investors themselves, will continue to fuel growth in the socially responsible investment sector, estimated to be worth in excess of US$22 trillion globally.1

At IFM Investors, we define responsible investing as the integration of environmental, social and governance (ESG) factors into investment decisions and stewardship. Alongside over two thousand signatories of the United Nations supported Principles for Responsible Investment (PRI), we believe sound management of these non-financial factors is essential to generating sustainable returns and value over the long term.2 We believe these principles are fast becoming the bedrock of culture and performance for investors globally, we also recognise that demonstrating tangible ESG action is crucial to building stakeholder trust at a time of increasing mistrust in financial institutions.

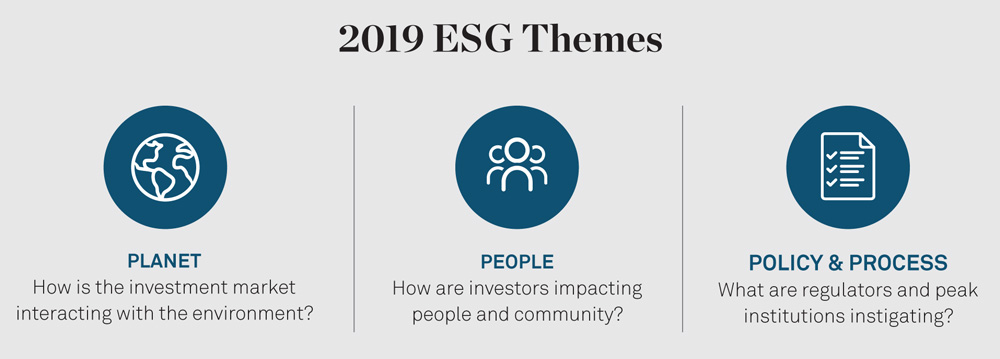

The ESG trends on our radar for 2019 are not only important to us, but also to investors more broadly. Notwithstanding the interconnections between ESG themes, we have grouped them into three thematic areas: Planet, People, and Policy & Process. These themes align closely with the IFM Investors Responsible Investment Charter and reflect key elements of our organisational purpose statement including our commitment to investing for the long term, respecting labour rights, and environmental and social responsibility.

1 Global Sustainable Investment Review 2016 http://www.gsi-alliance.org/wp-content/uploads/2017/03/GSIR_Review2016.F.pdf

2 UN Principles of Responsible Investment https://www.unpri.org/signatories

Meet the author

Related articles

Economic Update June 2025

IFM’s Australian operation secures Family Inclusive Workplace certification