Register your interest: Infrastructure Insights Series

Register your interest for our invitation-only Infrastructure Insights Series to explore the strategic role infrastructure can play within a portfolio - and where new opportunities are arising. Select your preferred location from the options below.

Geneva insights session

Just a 10-minute walk from Geneva Cornavin station, join our infrastructure experts for the latest insights.

Vienna insights session

Hosted within Vienna's Golden Quarter, join senior investment peers to discuss the challenges and opportunities in infrastructure today.

Frankfurt insights session

Moments from The Zeil, explore the latest infrastructure insights with our experts.

Stuttgart insights session

Located near Stuttgart's city center and close to the train station, join infrastructure leaders to explore the investment landscape.

Amsterdam insights session

Hosted by the Prinsengracht canal, join IFM Investors’ infrastructure experts to gain new insights into the infrastructure opportunity on a local and global scale.

Stockholm insights session

Just a short walk from Nybroviken, sit down with leading infrastructure minds to understand the investment landscape amidst new pressures on critical infrastructure.

Helsinki insights session

Hosted by Helsinki’s business district, join our experts to understand the infrastructure opportunity set at both a regional and global level.

Access our insights

Private Markets 700 - 2025 research & trends

This paper explores the case for infrastructure debt. We believe the asset class can present attractive risk-adjusted returns for investors, while its resilient fundamentals make it diversifying to other forms of private credit.

Our learnings from three decades of infrastructure investing

Our learnings from three decades of infrastructure investing - IFM Investors has been investing in unlisted infrastructure assets globally for nearly three decades. Since our inception we have been at the forefront of advances in this asset class and we have many learnings and insights to share.

Aleatica: A case study

A leading transportation operator, with a focus on the development and operation of toll roads and other mobility assets, can make for an attractive investment, as this case study explores.

Optimising private market asset allocations

Chief Economist Alex Joiner examines the integration of private market assets into the traditional portfolio space to assess performance impacts across investor risk profiles, and how unlisted infrastructure has the most potential to improve portfolio Sharpe ratios.

The fundamentals of Infrastructure Debt

This paper explores the case for infrastructure debt. We believe the asset class can present attractive risk-adjusted returns for investors, while its resilient fundamentals make it diversifying to other forms of private credit.

Digital portfolio: A debt case study

The rise of 'always on' connectivity, artificial intelligence (AI), and the digitization of our economy have combined to position digital as one of the fastest growing sub-sectors of infrastructure, as this case study explores.

Infrastructure knowledge hub

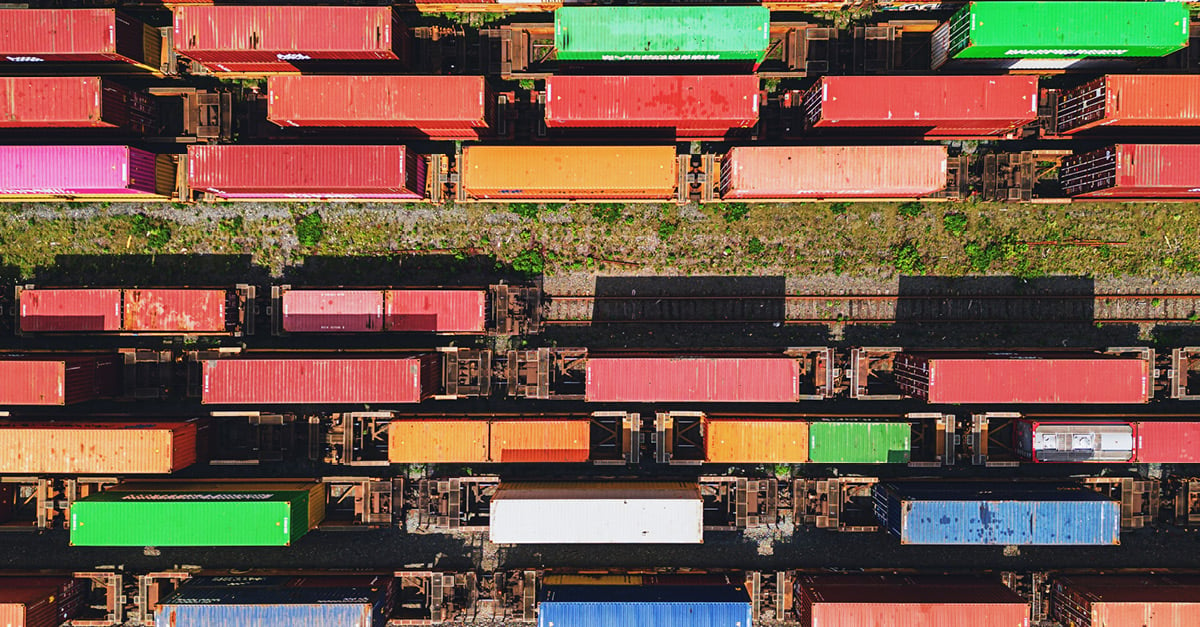

Infrastructure is increasingly on investors’ minds. Our 2025 Infrastructure Horizons report comes as investors are looking at new opportunities in growing areas like artificial intelligence, data centres, renewable natural gas, sustainable aviation fuel and the energy transition, as the asset class continues to mature. Read more in our full report on our Infrastructure knowledge hub.