Economic Update March 2020

Virus to challenge economies and markets

The sense of cautious optimism that greeted 2020 has already evaporated following the emergence of a new virus. China – the epicentre of the outbreak – is likely to suffer a material economic shock that will reverberate globally, given its strict containment measures. Other countries have also been forced to implement economically disruptive policies, further compounding the issue.

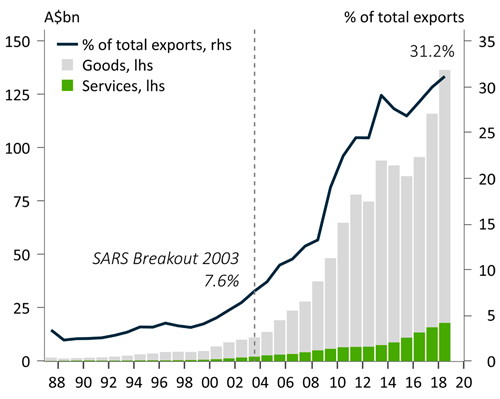

Australian exports of goods and services to China

Australia is heavily exposed to China like few others

Sources: IFM Investors, DFAT, Macrobond

Considering the nature of this shock, Australia is particularly exposed as China is far and away our largest trading partner for both goods and services. Resources exposure, via iron ore and coal, is well understood but more recently, it is the services export boom that has been important for Australian growth. Chinese nationals account for around one in four students enrolled in the education sector and one in six tourists. It is via this services exports channel that COVID-19 will impact most heavily the Australian economy.

You can read a summary or download the full Economic Update (March 2020) by downloading the article PDF.

Meet the authors

Related articles

Economic Update June 2025

IFM’s Australian operation secures Family Inclusive Workplace certification