The case for Australian Private Equity

Why Private Equity?

AK:

Traditionally, private equity has been considered a ‘return enhancer’ for institutional investors. According to the Burgiss Database, the median private equity fund has exceeded the Russell 2000 total return index by 474 basis points per annum over the long term1. Top quartile funds have exceeded that index by more than 12% per annum. This historical outperformance has enabled investors to effectively validate the inherent illiquidity of the asset class.

Private equity is also usually recognised for its diversification benefits. As is well known, the number of listed companies in the US and Europe has declined substantially over the past two decades. As a result, institutional investors have increasingly sought out private equity to diversify their holdings. Private equity is also able to provide investors with access to smaller companies and more innovative parts of the real economy, such as healthcare, technology, business services companies.

Why Australian private equity?

AK:

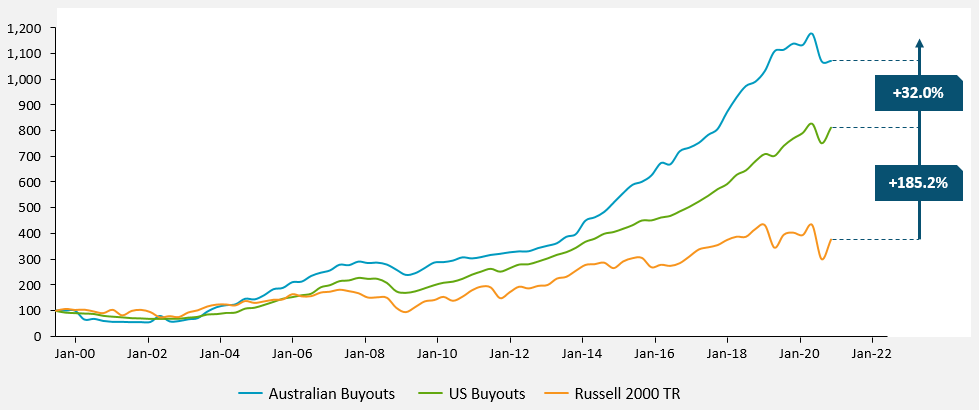

Australia is an interesting market – historically it’s been a prominent return enhancer for investors. Chart 1 shows the time-weighted rate of return index over the past two decades where Australian Private Equity has out-performed US private equity buyouts by 1.3x and is significantly above the Russell Total Return Index. But not only has Australian private equity delivered historically higher returns, it’s also done so with relatively lower risk.2

Australian buyout index vs. US buyout index vs. Russell 2000 TR3

Australian private equity companies typically take on less debt. And it’s a far less competitive market for investors, especially in the lower and mid-market segments where we focus our attention. There are more than 20,000 companies with AU$10m to AU$250m annual revenue, but only between 1,000 and 1,500 companies with revenue over AU$250m. So there is a large opportunity set.

Can you explain your long-term ‘growth’ focus and where you see things heading in 2021?

AK:

Unlike the listed equities sector, which is all-too-often driven by short-term share price movements, in private equity we’re able to take a much longer term view. We provide capital, identify and fill talent gaps, invest in new technology and provide long-term strategic planning that is all about driving long term growth. We don’t look for distressed assets; but instead focus on strong businesses in growing sectors that we can support.

A great example is our investment in My Plan Manager, which was founded in 2015 and is now Australia’s largest provider of plan management services to NDIS participants. It recently achieved second place on the list of fastest-growing technology companies at the Deloitte Technology Fast 50 2020 awards. Another example is our more recent investment in Zuuse, a fast growing, global provider of construction payment management Software as a Service (SaaS) solutions to the US$1 trillion-dollar global construction and building operations sector.

Australian private equity is a very exciting space right now. During 2020, the COVID-19 pandemic demonstrated where businesses are – and are not – resilient. And the assets that we see coming to market are typically those that have performed reasonably well through COVID, in some cases very well. Looking forward, we believe that 2021 is likely to offer high quality investment opportunities, particularly in the mid-market.

1 Burgiss Database as at 30 June 2020 as accessed on 11 November 2020; Includes 1,578 private equity funds with US$2trn of committed capital raised between 2000 and 2017. Returns are net of fees and carried interest and in the funds local currency.

2 Past performance does not guarantee future results. The assertion is based on a comparison of risk/return by primary geographic focus (2010-2017) of “AIC: Private Capital Market Overview: A Preqin and AIC Yearbook 2020” where private capital includes the following strategies: private equity, venture capital, infrastructure, private debt and natural resources; funds raised between 2010 and 2017.

3 Past performance does not guarantee future results. TWRR Index of net returns assuming investment in every fund. (Chart source: Burgiss Private IQ database; Returns as at 30 June 2020; Australian Buy-out funds exclude Asian pan regional funds.)

Meet the author

Related articles

Economic Update June 2025

IFM’s Australian operation secures Family Inclusive Workplace certification