Will Australian interest rates go negative?

In the midst of a global pandemic, with central banks providing significant liquidity to financial markets and experimenting with unconventional monetary policy, the prospect of negative interest rates is once again a focus and concern for fixed income and cash investors. In short-term interest rate markets, the Bank Bill Swap Rate (BBSW) has traded below 0.1%, so Australia is already very close to negative interest rates, making it quite possible that yields could briefly trade below zero.

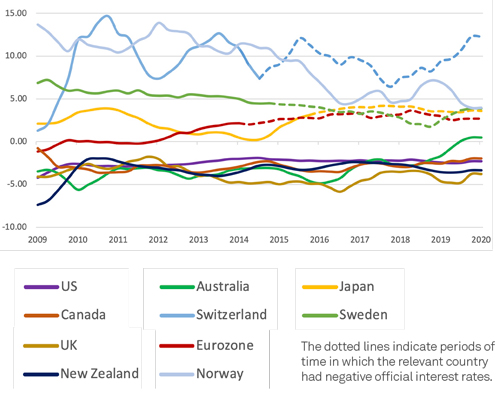

CURRENT ACCOUNT BALANCE (% OF GDP)

Source: Bloomberg, June 2020

However, we believe the probability of persistent negative interest rates remains quite low in Australia, mainly due to the Reserve Bank of Australia’s preference for other monetary policy tools and the fact that Australia has a current account deficit and a positive cross currency basis spread, both of which appear inconsistent with prolonged negative rates.

For rates to go sustainably negative in Australia, we would need these factors to change – possibly due to a combination of very weak inflation, a strong AUD and potentially a global move towards more negative rates. Given the uncertain outlook and unprecedented level of central bank stimulus, we are clearly living through a period in which negative interest rates feel much closer to home for Australian investors.

Meet the author

Related articles

Economic Update June 2025

IFM’s Australian operation secures Family Inclusive Workplace certification