Flying into the future: Shifting to sustainable aviation fuel sources

Key takeaways |

|

Decarbonisation of aviation remains a significant global challenge, with sustainable aviation fuels (SAF) offering the only currently available medium-term pathway to lowering the sector's emissions. |

|

Government mandates and production fuel credits have proven effective in encouraging production of SAF globally. Airline-dependent Australia has only recently started its own process. |

|

IFM Investors is working with the Australian government and industry to help leverage the country's advantages and get a domestic SAF industry off the ground. |

Introduction

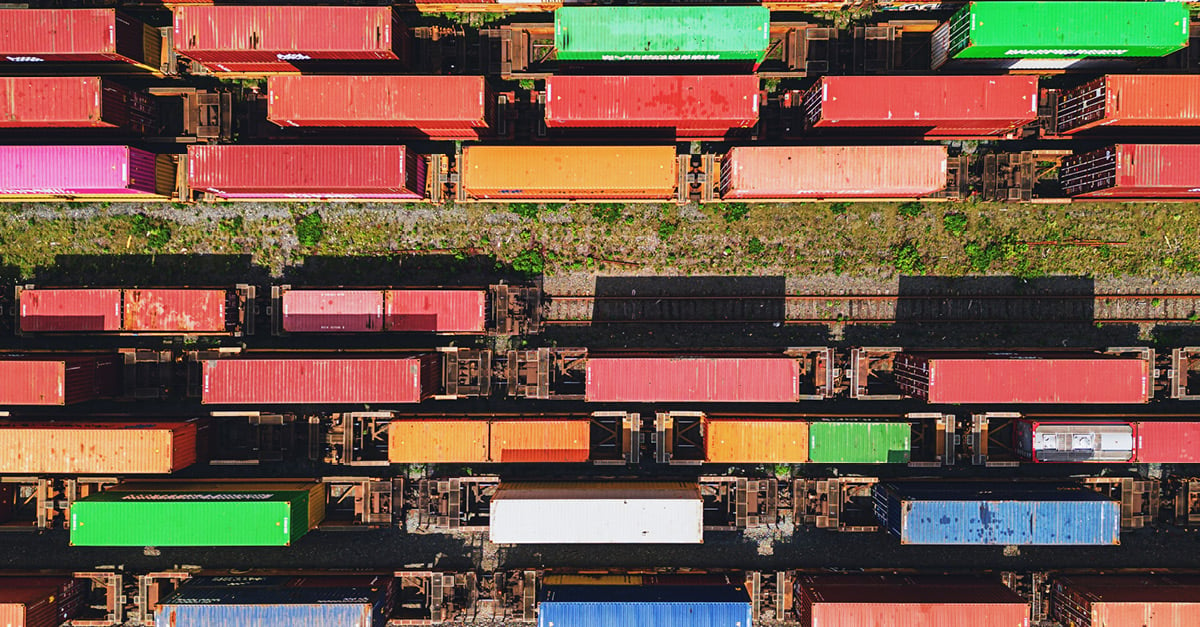

Maintaining the freedom and connectivity that comes with frequent, affordable air travel while decarbonising is a significant global challenge. Over 20% of global carbon emissions come from the transport sector and while some of these emissions can be readily addressed, the 2% stemming from aviation are considered particularly hard-to-abate. This is because the energy density requirements of commercial flight are difficult to meet using electrification or hydrogen. To decarbonise aviation, a fuel that is lighter than batteries and denser than hydrogen is needed. Sustainable aviation fuel (SAF) meets these criteria and is the only medium-term pathway to decarbonise aviation. By 2050, 80-90% of aviation fuel is expected to be SAF, reducing global aviation emissions by 62%.

Where traditional aviation fuel is produced from crude oil, SAF can be produced from a range of feedstock readily available, including canola oil. Other SAF feedstocks include sugar crops, waste oils, municipal rubbish and agricultural residues.

Unlike other decarbonisation pathways envisaged for aviation, such as engine and aircraft advancements, electrification, and hydrogen, SAF is a ‘drop-in’ ready fuel which can be blended with existing jet fuel, without significant alterations to airplane engines and refuelling infrastructure.

As a key decarbonisation lever in aviation, SAF is increasingly used across the aviation supply chain. The International Air Transport Association estimates SAF production will reach 2.7 billion litres in 2025. This would equate to 0.7% of all global jet fuel, more than doubling its share compared to the year prior. In the UK, Manchester Airports Group (MAG), a portfolio company of one of IFM Investors’ funds, was instrumental in calling for the now-legislated UK mandate of 10% SAF usage by 2030. In the US, New York’s LaGuardia Airport first distributed SAF to an airline tenant in 2022, transporting the fuel from a Texas refinery nearly 1,500 miles via two existing pipeline systems – those operated by Colonial Pipeline and Buckeye Partners, both owned by one of IFM Investors’ funds. As an owner of multiple Australian airports, including Sydney Airport, Melbourne Airport, Brisbane Airport and Adelaide Airport, rollout of SAF in Australia is a critical component in the continued decarbonisation strategy of IFM’s portfolio. Where many airports, including those owned by IFM, have successfully tackled Scope 1 and Scope 2 emissions, for instance by installing on-site solar arrays, procuring renewable energy via power purchase agreements or electrifying fleet vehicles, most of an airport’s Scope 3 emissions come from aircraft emissions.

Currently, however, global SAF supply is constrained, with 77 in-production SAF refining facilities which produced an estimated 1,900ML of SAF, or approximately 0.5% of total aviation fuel demand in 2024. Of this, the overwhelming majority has been produced via the Hydrogenated Esters and Fatty Acids (HEFA) process, and S&P forecast 70% of all SAF will still be made via the HEFA process in 2030. By 2050, global SAF demand is forecast to reach 330ML/d with the highest penetration in Europe (c. 50%) and North America (c. 35%). Commitment to increasing the global SAF supply is therefore necessary, with the Clean Skies for Tomorrow global target of 10% SAF across the aviation supply chain by 2030 backed by the wider industry, including Brisbane Airport.

For more, please read the full paper, Flying into the future: Shifting to sustainable fuel sources.

This article is part of IFM Investors' 2025 Infrastructure Horizons trends report.

Meet the author

Related articles

Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

Deglobalisation’s impact on infrastructure

Expanding horizons: Infrastructure’s maturing as an asset class demands fresh thinking

Gas into gold: The waste-to-energy opportunity

AI at a crossroads: How AI is reshaping infrastructure