Inflation: considerations for real assets

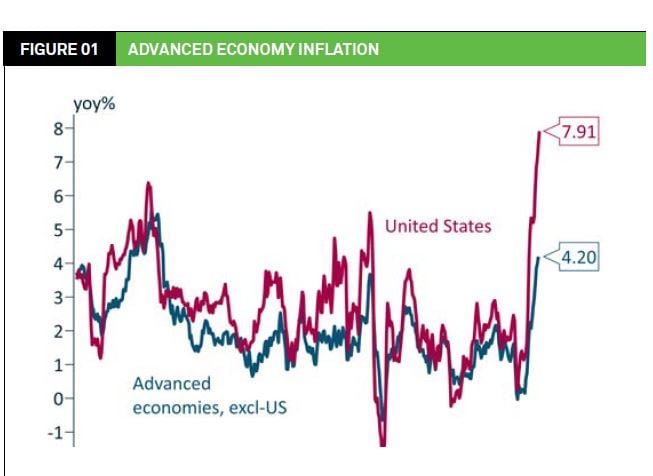

Inflation concerns have been front and centre in conversation for global investors and consumers alike in recent months. Since the beginning of the pandemic, supply-side constraints in the face of strong demand have created disequilibrium, driving inflation higher, and now the conflict in Eastern Europe will likely exacerbate that risk by boosting commodity prices further.

Inflation concerns have been front and centre in conversation for global investors and consumers alike in recent months. Since the beginning of the pandemic, supply-side constraints in the face of strong demand have created disequilibrium, driving inflation higher, and now the conflict in Eastern Europe will likely exacerbate that risk by boosting commodity prices further.

Advanced Econonmy Inflation

Source: IFM Investors. BLS, Federal Reserve Bank of Dallas

Such a spike in inflation in advanced economies has not been experienced for decades and there is uncertainty as to how and when it will be resolved. Asset owners like IFM Investors, now face the added challenge of navigating this maze of regional and global inflationary pressures and interpreting the implications for real asset investments.

In this environment, asset owners need to manage debt facilities carefully. Traditional floating rate exposures have worked for debt facilities over the last few decades. We believe it is prudent to seek advice on both the structure of debt facilities, any hedging required and the level of interest rates (fixed and floating) in order to address interest rate exposures.

Meet the authors

Related articles

Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

Investing in Australia: Accelerating industry super investment and growing Australia’s housing supply