Our capabilities

Across a diverse range of investment capabilities, we endeavour to invest capital responsibly, sustainably and positively.

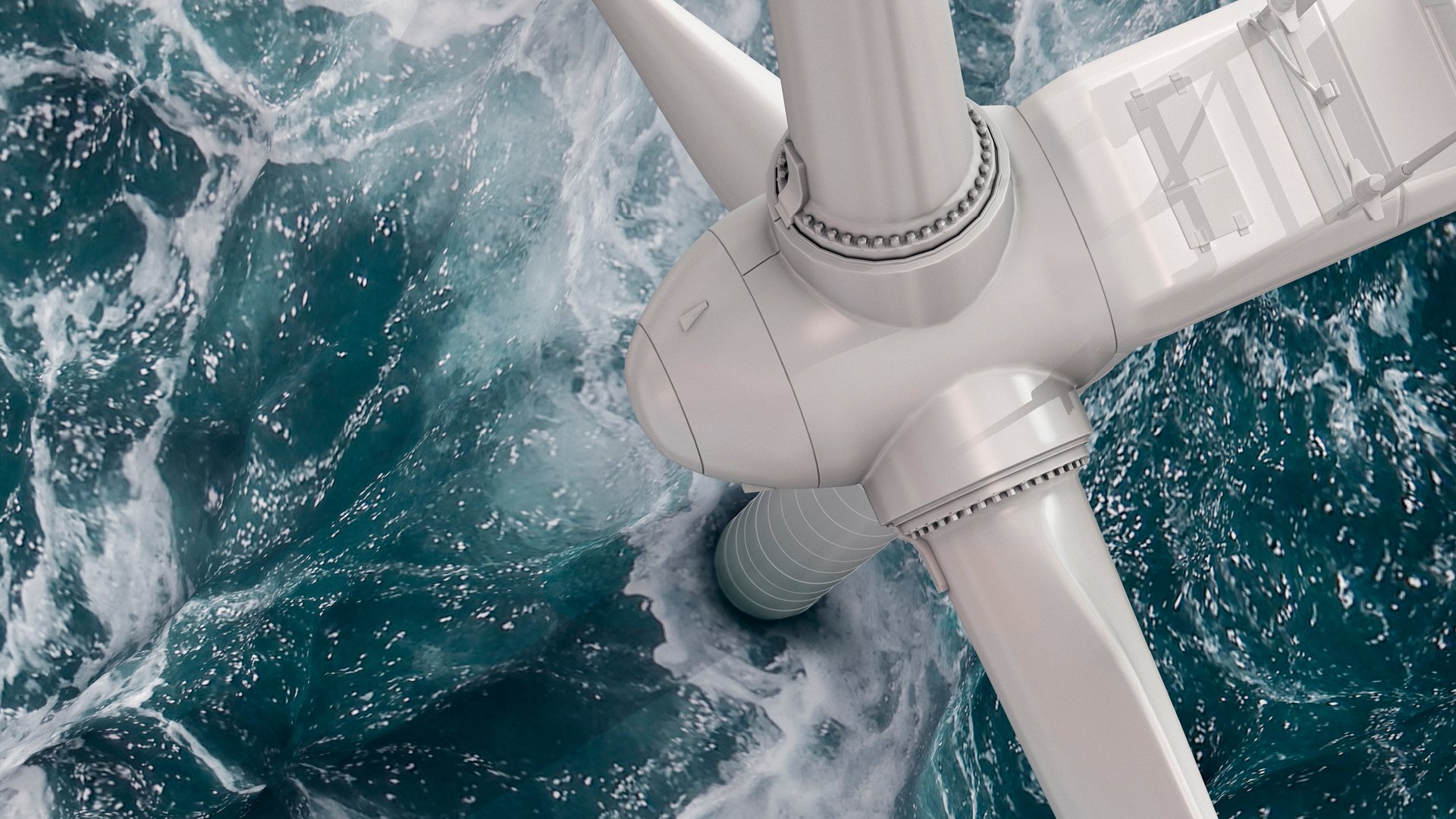

Infrastructure Investments

We invest in low carbon and global core infrastructure strategies…

Debt Investments

We invest across a diverse credit spectrum, including Specialised Credit, Treasury and Infrastructure Debt strategies …

Private Equity Investments

We acquire and invest in companies across Growth Equity and Long-Term Private Capital strategies …

Market insights

Know-how

Learn how IFM can help investors unlock the value of infrastructure investing, turning opportunity into potential outcomes.

Access Private Markets 700 research

New research shows institutional investors are asking more from their private markets' allocations – more risk management, higher returns and more sophisticated solutions. Explore the latest private markets trends and strategies, according to 700+ investors.

Solving the energy trilemma

In this webcast, IFM Investors joins IPE to explore its integrated approach to the energy transition, leveraging nearly 30 years of global infrastructure experience. The discussion will share practical insights, real‑world examples, and lessons from across the energy value chain.

Learn about latest insights in institutional investment management, and forward-thinking perspectives from our industry experts.

The Private Markets Macro Outlook 2026

2025 Annual Sustainability Report

Mobilising pension capital for net zero: a policy blueprint for the UK

More than 25 years ago, IFM Investors was conceived and created by a collective of pension funds. Today, we are a leading global institutional asset manager, working to create a better future for working people.

Infrastructure knowledge hub

Infrastructure is increasingly on investors’ minds. Our 2025 Infrastructure Horizons report comes as investors are looking at new opportunities in growing areas like artificial intelligence, data centres, renewable natural gas, sustainable aviation fuel and the energy transition, as the asset class continues to mature. Read more in our full report on our Infrastructure knowledge hub.