Expanding horizons: Infrastructure’s maturing as an asset class demands fresh thinking

|

Key takeaways |

|

Investors need to consider infrastructure opportunities in terms of risk exposure and return characteristics, rather than pursuing a singleminded focus on core assets. |

|

Engaged, active asset managers can extract additional returns through targeted capital expenditure, expanding assets in what is often a proprietary deal. |

|

A growing number of thematic opportunities, developing assets, or those adjacent to traditional infrastructure offer the potential for higher returns and the possibility to add value. |

Introduction

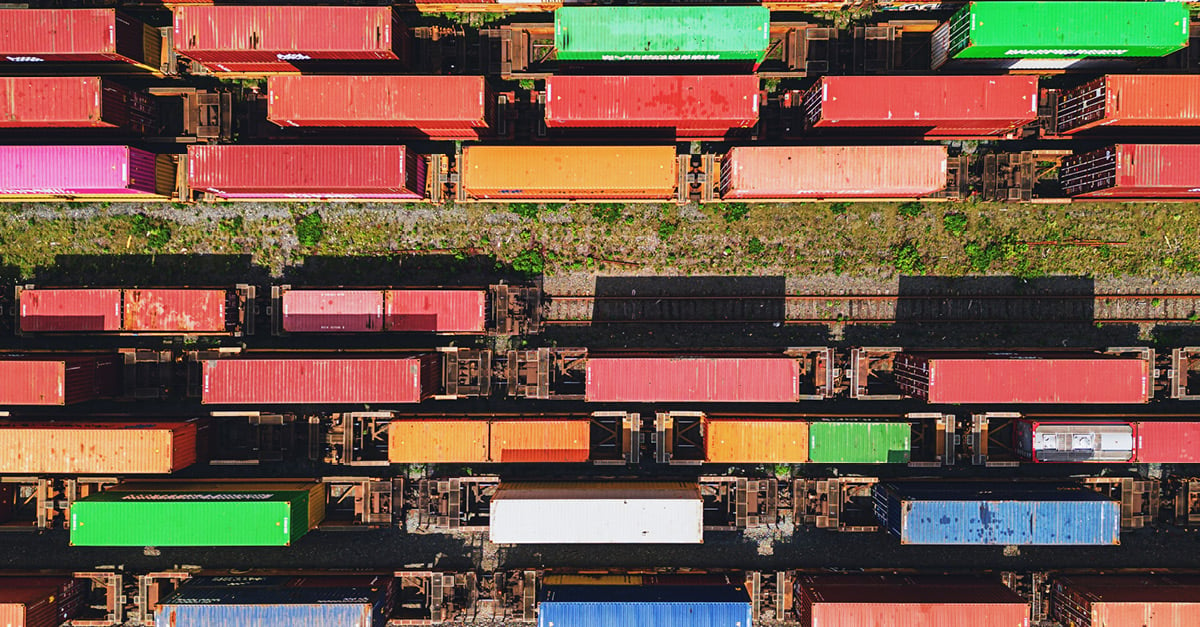

For decades, infrastructure was viewed as a reliable, homogenous asset class, with airports, toll roads and utilities the cornerstone of institutional investors’ exposures. In Australia, where superannuation funds began investing in infrastructure 30 years ago, they have reaped the benefits of long-term ownership of many of the country’s busiest air and sea ports. Their buy-and-hold approach is now sought after as the model to emulate by governments the world over.

But as infrastructure matures, and interest from institutional investors continues to grow, it is time to move away from the perception of infrastructure as a monolithic sector. We should instead consider opportunities in terms of the risk taken on, the sectors in which we invest, and the assets’ distinctive return characteristics.

Infrastructure as ballast and buoyancy

The maturing of infrastructure will be an evolution rather than a revolution. The asset class will retain the same fundamental traits: cashflow generative, backed by hard assets, socially vital and difficult to replace, with significant barriers to entry and low competition. We can view infrastructure in nautical terms – as a ship’s ballast, which also supplies buoyancy. It provides resilience and stability (the ballast), while also offering the potential for returns to support portfolio outcomes (the buoyancy). Its resilience stems from the fact that infrastructure assets often underpin a well-functioning society. Its users rely on the freight moved through sea ports or the water provided by utilities, regardless of economic circumstances. Both infrastructure equity and debt can provide the ballast and buoyancy that appeal to investors.

Yet as the sector matures, we can start to shift away from labels that no longer reflect its evolving dynamics. Toll roads and airports have traditionally been viewed as core infrastructure assets. Today it can be more useful to think of infrastructure in specific sectoral terms, such as where to consider an allocation to transportation, social and energy infrastructure or utilities.

For more, please read the full paper, Expanding horizons: Infrastructure’s maturing as an asset class demands fresh thinking.

This article is part of IFM Investors' 2025 Infrastructure Horizons trends report.

Meet the author

Related articles

Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

AI at a crossroads: How AI is reshaping infrastructure

Deglobalisation’s impact on infrastructure

Flying into the future: Shifting to sustainable aviation fuel sources

Integrating renewable energy and digital infrastructure: Pioneering the next generation