Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

The trends and forces reshaping the future of infrastructure investing

In 2025, infrastructure is increasingly on investors’ minds. This comes as governments pursue investment to fuel growth and enhance energy security, while the digitisation, decarbonisation and deglobalisation trends draw in private capital.

At the same time, geopolitical tensions and the rise of protectionist policies risk a resurgence of price pressures and market volatility. Against this backdrop, we believe infrastructure’s role as an inflation hedge and its historically reliable returns have come into sharper focus.

Infrastructure is also maturing as an asset class. The development of equity and debt solutions across the risk spectrum is driving new commitments. Infrastructure investors are working with governments to help set the agenda and put capital to productive use. Meanwhile, we believe new opportunities such as data centres and facilities adjacent to air and sea ports are blurring the boundaries with other asset classes, including real estate.

This report focuses on the themes and trends that we see reshaping the infrastructure market in 2025, including:

Infrastructure’s horizons expand

Investors are moving beyond a monolithic view of infrastructure to focus on the distinct risk-return profiles of infrastructure equity and debt, of different sectors, sizes of deal, thematic exposures and of developing, mature and adjacent opportunities.

Flying into the future

How can we reduce airline emissions? Sustainable aviation fuel is the only medium-term pathway currently available to decarbonise aviation. Encouragingly, it requires little change to either existing aircraft or refuelling infrastructure.

Turning trash into treasure

New types of energy production are turning a problem into a solution – or agricultural and municipal waste into a sustainable source of fuel. We look at how emissions from landfill and farm waste are being transformed into renewable natural gas.

AI’s challenges and opportunities

Data centres are powering the AI boom. Together with fibre networks, we believe they are creating enormous investment opportunities. AI can also revolutionise productivity across infrastructure assets – but we cannot ignore the challenges it brings.

The next generation of energy

To meet rising energy demand, the next generation of energy must integrate various renewable sources with innovative energy solutions, with co-location of energy and energy-intensive infrastructure on the rise.

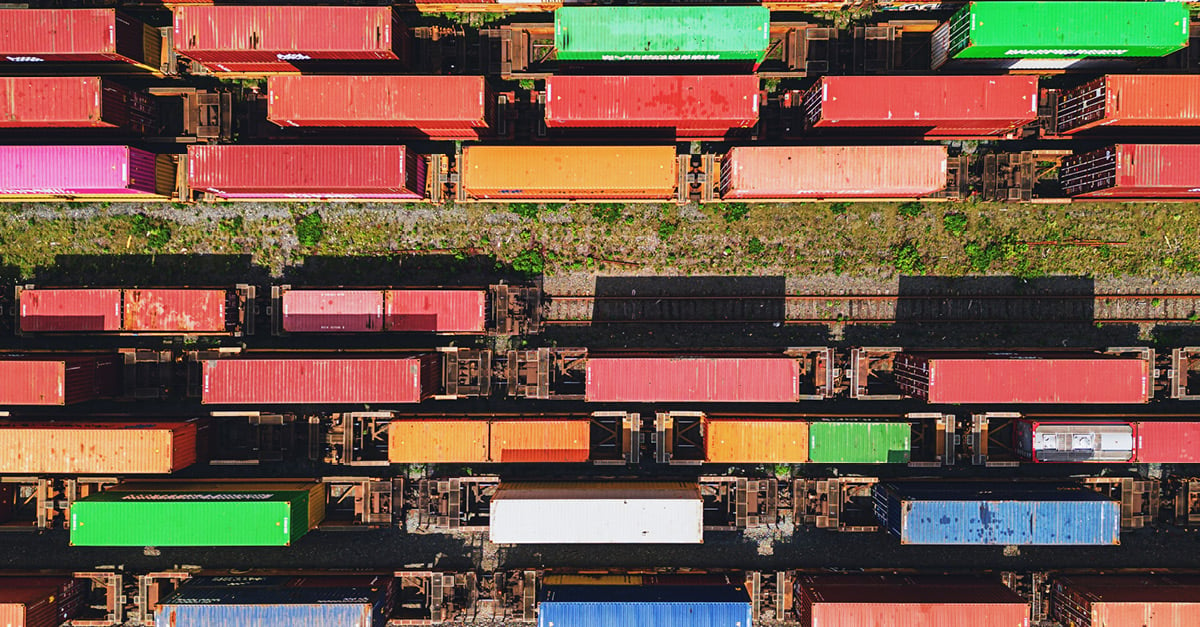

Deglobalisation and infrastructure

In a fracturing world, governments are focusing on energy independence and boosting advanced manufacturing capabilities. Such shifts are reshaping the opportunities for investors in infrastructure debt.

For more, please read the full report, Infrastructure Horizons: The forces shaping the future of infrastructure investing.

Related articles

AI at a crossroads: How AI is reshaping infrastructure

Expanding horizons: Infrastructure’s maturing as an asset class demands fresh thinking

Deglobalisation’s impact on infrastructure

Integrating renewable energy and digital infrastructure: Pioneering the next generation

Flying into the future: Shifting to sustainable aviation fuel sources

Gas into gold: The waste-to-energy opportunity

Infrastructure knowledge hub

Infrastructure is increasingly on investors’ minds. Our 2025 Infrastructure Horizons report comes as investors are looking at new opportunities in growing areas like artificial intelligence, data centres, renewable natural gas, sustainable aviation fuel and the energy transition, as the asset class continues to mature. Read more in our full report on our Infrastructure knowledge hub.