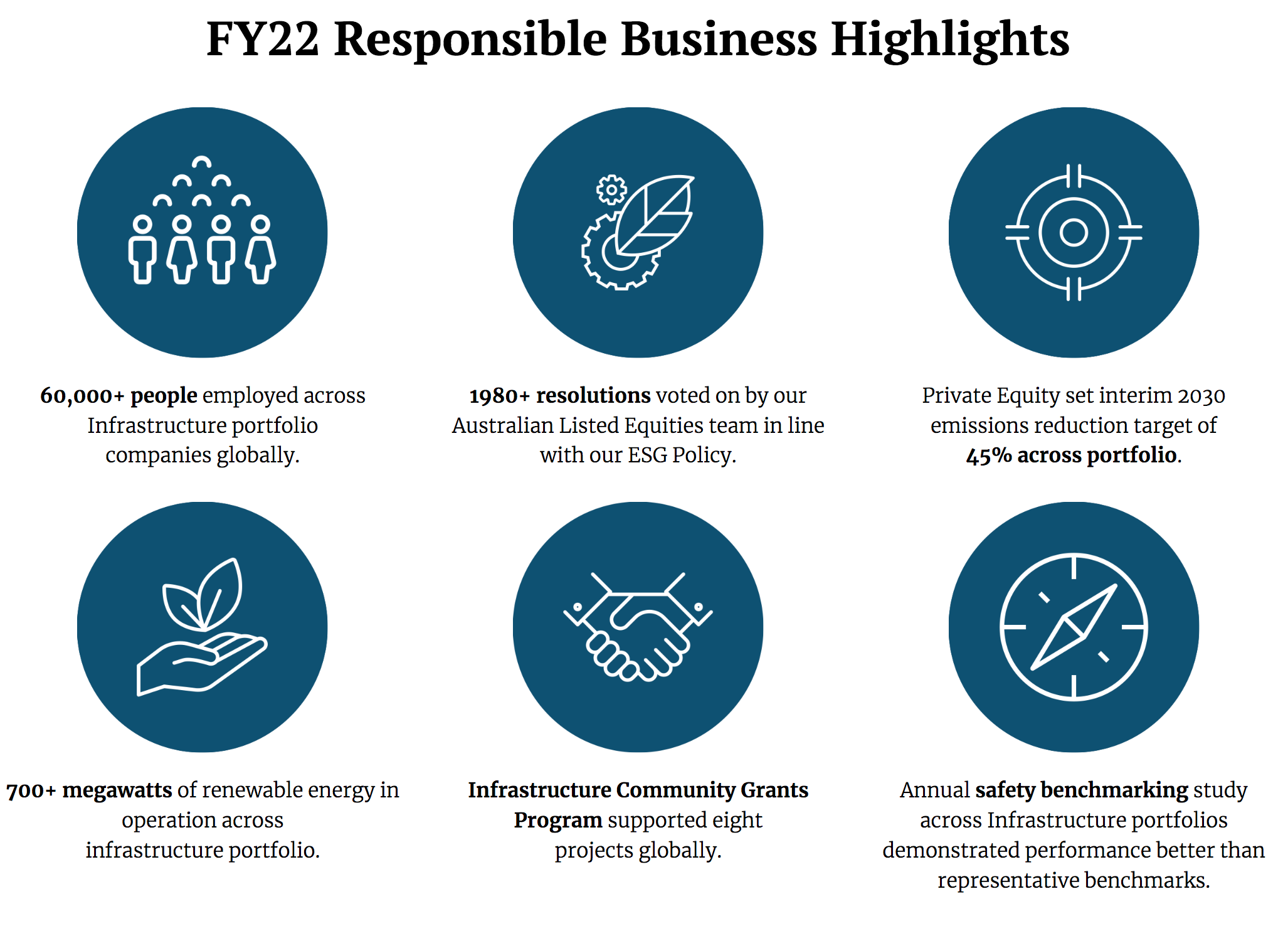

Our responsible business approach underpins our financial performance for our investors as we pursue our purpose, which is to protect and grow the long-term retirement savings of working people around the world.

We embed environmental, social and governance (ESG) considerations across our investment and corporate practices. This supports us to manage risk and build value in ways that contribute to the long-term health of the environmental, social and economic systems in which we operate.

As responsible long-term investors, we recognise that we have a role to play in supporting the broader environmental, social and economic systems that we depend upon for our portfolios to prosper. The quality of investment returns in ten and twenty years’ time depends on the quality of the system in ten and twenty years’ time.

Meet the author

Related articles

Modern slavery in global equities portfolios

The Private Markets Macro Outlook 2026