The rise and rise of electric vehicles … and what it (potentially) means for Australian small cap miners

Can you connect the dots for us? What’s the relationship between the global energy transition to a low carbon world and Australian small cap miners?

JC:

In short, it’s all about battery technology. I think the best TV ad that played during 2021 Superbowl1 was made by General Motors. What made it really stand out for me was the commitment behind it: that 100% of General Motors’ light-duty vehicles would transition to zero-emission by 2035 and it would become a carbon-neutral automaker by 2040. This follows the Biden administration’s decision to replace the government’s entire fleet of 645,000 federal vehicles with US-built electric cars, vans and trucks.

So we know that the transition to electric vehicles is well underway, and we are now seeing a surge in demand for the minerals that go into batteries.

UBS eloquently describes these minerals as the “heart of an electric vehicle”2 and their projections suggest that a 40% penetration of electric vehicles by 2030 will create approximately a 13-fold increase in battery demand that requires more than an eight-fold increase in lithium demand, a five-fold increase in natural graphite demand and a tripling in the demand for cobalt and rare earth minerals.

Lithium is the cornerstone of much new technology and Australia is the world’s largest lithium exporter, currently delivering around 50 percent of global supply3. Approximately 20 percent of the Australian small cap sector is made up of mining stocks, and battery metal exposure accounts for around 6 percent. The lithium sector is relatively liquid, readily traded - and volatile!

How has the lithium story played out in Australia so far?

JC:

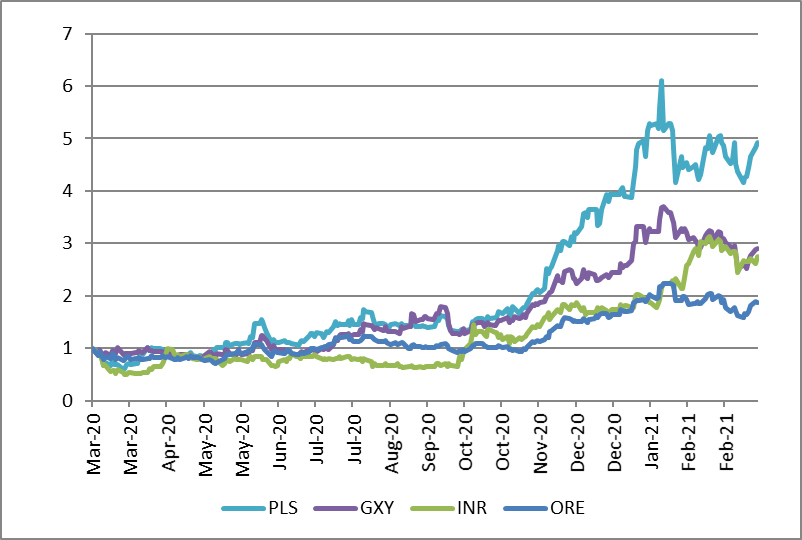

We recognise the logic of the lithium story and it has formed part of our investment thesis for specific stocks in the past. But because of the volatility, it’s a tale that requires careful monitoring and active management.

It’s rare that rational projections of mineral supply and demand unfold linearly. In 2018, pricing of lithium and lithium equities got well ahead of the fundamentals as new Australian hard rock supply capacity was delivered ahead of converter capacity in China and end user demand. But fast forward two years and a combination of converter capacity buildout, supply discipline and a dramatic acceleration of demand (particularly in Europe due to COVID related ESG focused stimulus programs), means the market is looking much tighter in the medium term and potentially in deficit post 2025.

To navigate this market effectively however will require active management that is sensitive to supply demand fundamentals and a keen eye on sovereign policy and corporate targets.

How do you approach investing in small cap Australian lithium stocks?

JC:

Lithium comes from brines and hard rock sources, which imply very different capital expenditure, operational expenditure and risk profiles. While Australian deposits are hard rock, the ASX provides exposure to both. The miners have been nimble in understanding the importance of strategic technical and offtake relationships with large offshore partners are they’re increasingly going downstream to sell higher value lithium hydroxide rather than just spodumene concentrate.

I am a geologist by training, having worked in underground gold operations in Western Australia. A technical background is helpful in understanding this space, although I think for many, myself included, the battery metals theme will continue to be a steep learning curve!

The IFM Small Cap Active Equities team collectively deploys a focused, fundamental stock picking approach, enhanced by quantitative methods and designed to target attractive investments and control portfolio risk.

This involves building a business case for each mining stock and assessing the potential risks and opportunities it faces. We calculate an in-house valuation for each company, and target those that we believe the market is currently undervaluing.

Ultimately, it’s a relative game - if there are, say, ten lithium miners that we can invest in, our aim is to 1) take a view on the appropriate weighting to lithium, and 2) be selective about which stocks we own.

1 Note: ‘Watchmojo’ – one of the largest channels on YouTube with 23 million subscribers – only judged it to be Number #8 but for the other reasons stated, I thought it was the best.

2 UBS, Q-Series "Tearing down the heart of an electric car”, Nov 2018; “Tearing Down the Heart of an Electric Car Lap 2”, October 2020; “Battery Raw Materials, From mine to motor – can supply keep pace with demand?”, November 2020.

3Source: JP Morgan “Lithium sector Deep Dive: Increasing demand, new supply sources & maturing supply chains” 25 February 2021. funds.

Meet the author

Related articles

Economic Update December 2025

Three reasons to invest in Infrastructure Debt today