Key takeaways

-

This report highlights the risks, opportunities and challenges of addressing modern slavery in global equities.

-

Our approach is to stay committed to help eradicate modern slavery globally by working collaboratively with investor coalitions, non-governmental organisations (NGOs), and regulatory bodies, to amplify pressure on listed companies to improve labour practices through joint advocacy.

-

Modern slavery, including forced labour and human trafficking is a pervasive global issue involving severe human rights violations. We believe this is not just a moral issue; it is a financial one.

-

In 2021, approximately 50 million people worldwide were estimated to be living in situations of modern slavery, generating US$236 billion annually from forced labour.

Modern slavery, including forced labour and human trafficking is a pervasive global issue involving severe human rights violations. In 2021, approximately 50 million people worldwide were estimated to be living in situations of modern slavery1, generating US$236 billion2 annually from forced labour.

At an address to the 2025 Australian Council of Superannuation Investors Conference, the Australian Anti-Slavery Commissioner noted that modern slavery is not just a moral issue; it is a financial one. “Modern slavery is a business risk. Understanding risk is good for business and good for investors,” further noting that “there is clearly an economic impact for brands and investors that are not getting this right.”3 For global equities investors and companies, addressing modern slavery is both a moral and business imperative, impacting efficiency, reputation and compliance. Industries such as agriculture, manufacturing, and mining are especially susceptible due to complex supply chains.

IFM Investors (IFM) acknowledges its responsibility to respect all internationally recognised human rights, including those relating to freedom from modern slavery. Our approach to managing modern slavery risk includes striving for continuous improvement in our processes as we move towards best practice, transparency in reporting and continuing to meet our legal obligations. We seek to act in the best interests of our clients, their beneficiaries, and the millions of working people they represent. Our ongoing efforts aim to ensure ethical practices and sustainable growth, reinforcing our leadership in sustainability and our dedication to creating a positive impact in the global investment landscape.

49.6m people are living in modern slavery globally

Challenges of addressing Modern Slavery in Global Equites

A major challenge in addressing modern slavery in global equities holdings is the complexity of multi-tiered supply chains which can span multiple countries, often operating under different regulations and standards. Many listed multinational companies source materials and components through layers of subcontracting, often lacking transparency. This can obscure working conditions, making it difficult to ensure ethical practices.

For example, a listed company may purchase electronic components from a supplier that sources cobalt, a crucial component in rechargeable batteries, from mines in high-risk regions like the Democratic Republic of Congo (DRC). The DRC supplies much of the world’s cobalt and is often extracted under harsh and exploitative conditions.4 Due to complex supply chains, listed companies may struggle to achieve full visibility, making risk mitigation challenging.

Global equities investors face additional challenges as they hold positions in companies across jurisdictions with varying labour protections. Engaging meaningfully is difficult due to dispersed locations, complex ownership structures, and limited influence given minority equity positions. Additionally, varying legal frameworks and cultural contexts across countries can pose additional barriers to implementing consistent anti-slavery measures.

Weak enforcement mechanisms and inconsistent regulatory oversight further hinder accountability for listed organisations. While global initiatives such as the UK Modern Slavery Act and Australia’s Modern Slavery Act mandate corporate reporting on slavery risks, these legal and regulatory frameworks may not be robust enough to ensure effective compliance, and penalties for non-compliance may be insufficient to drive meaningful change. Many companies provide vague disclosures without concrete actions, and without global standards, assessing corporate antislavery efforts remains difficult for investors.

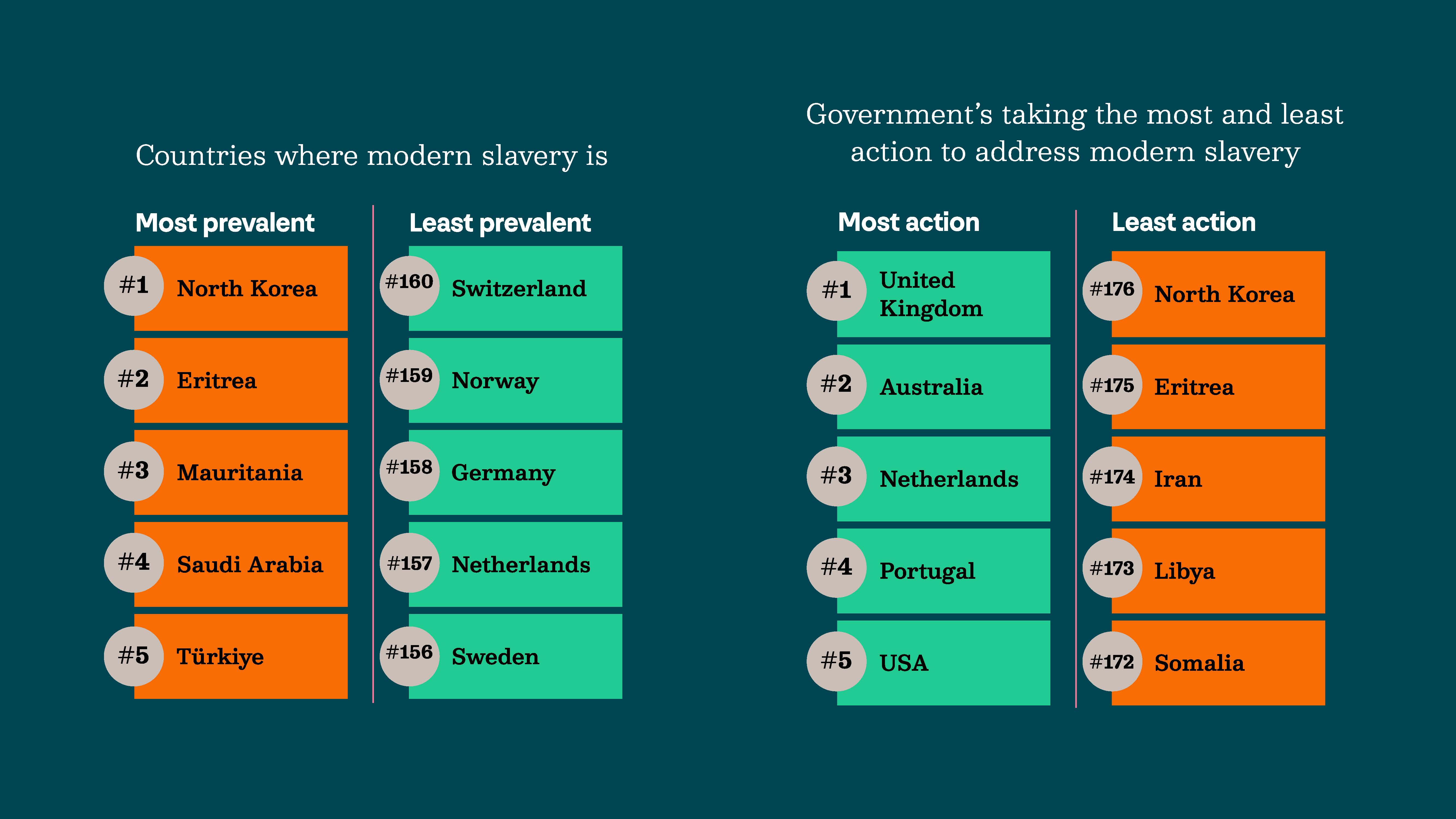

Source: https://www.walkfree.org/global-slavery-index/map/#mode=data

IFM’s approach

At IFM, we are committed to playing our role in helping to eradicate modern slavery globally, and we utilise both policy advocacy as well as publicly available quantitative information to do so. By working collaboratively with investor coalitions, non-governmental organisations (NGOs), and regulatory bodies, we can amplify pressure on listed companies to improve labour practices through joint advocacy, for example through our participation in initiatives such as the UK’s Taskforce on Social Factors. Chaired by IFM’s Chief Strategy Officer, and co-chaired by IFM’s Global Head of Sustainable Investment, this taskforce has a primary goal of supporting UK pension scheme trustees and the wider pensions industry with some of the key challenges around managing and measuring social factors in relation to their investments. These social factors include labour practices, supply chain and modern slavery issues, diversity and inclusion and others. Alongside advocacy, we share research and best practices through white papers to strengthen

anti-slavery efforts.

Many of our listed equities portfolio construction methodologies are determined by Investment Management Agreements between IFM and our clients. Our overall approach is to partner with clients and work together to develop an investment approach that seeks to satisfy their requirements.

For example, IFM manage one of our client’s global equities portfolios with an aggregate overweight to companies that have demonstrated a commitment to effectively manage labour risk. The strategy also incorporates material governance factors, as poor corporate governance may increase the risk of labour rights violations. Factors include strength of frameworks around labour, human capital management and governance, and recent involvement in severe labour rights violations.5

We utilise the MSCI ESG Manager portal as well as other third party data providers to access comprehensive ratings and sustainability data for global listed companies. This includes critical information on modern slavery and human rights, which we aim to incorporate into our screening processes for clients who have specified these criteria.

Where appropriate, we can also incorporate supply chain risk assessments into our approach. Upstream analysis helps identify risks in raw material sourcing and production, where forced labour is often prevalent, while downstream assessment examines distribution, retail, and end-user impacts. By integrating data-driven models, we have the potential to map supply chain vulnerabilities, predict high-risk areas, and enhance due diligence.

Boohoo case study

Although not an IFM held stock, the recent modern slavery incident at Boohoo.com highlights the risks, and the role investors can play.

Boohoo.com, a leading online fashion retailer, operates in the fast fashion industry, which is highly susceptible to modern slavery due to complex supply chains, high-volume production demands, and a lack of transparency.

In 2020, Boohoo faced significant scrutiny after media reports emerged that workers in Leicester factories supplying the company were being paid as little as £3.50 an hour, far below the minimum wage, while working in poor conditions.6 The media reports led to a sharp 33% drop in Boohoo’s share price in two days, wiping £1.6 billion off its market value. Its founders lost £335 million, and major retailers

like Next, Asos, and Zalando severed ties.7

In response, Boohoo implemented measures to enhance transparency, improving oversight, and protect workers.8

- Enhanced auditing and monitoring

Boohoo adopted stricter auditing standards, including the Fast Forward audit, which emphasizes worker welfare and ethical labour practices - Prohibition of unauthorised subcontracting

The company banned unauthorised subcontracting to ensure suppliers comply with its labour standards and prevent unethical practices. - Collaboration and Training

Boohoo invested in supplier training programs on sustainable practices, ethical operations, and labour law compliance. - Transparency and reporting

Regular modern slavery statements detail the company’s efforts to combat forced labour and improve working conditions. - Partnerships and initiatives

Boohoo collaborates with organisations like CottonConnect to promote responsible sourcing practices, support sustainable farming and improve workers livelihoods.

The impact from the Boohoo.com 2020 media reports prompted increased industry awareness, as businesses scrutinised supply chains and enhanced auditing, monitoring, and transparency. Many brands prohibited unauthorised subcontracting and strengthened compliance efforts. Consumer awareness of labour exploitation also grew, increasing demand for ethically produced goods and stricter brand scrutiny.9 The incident encouraged collaboration among brands, NGOs, and regulators through initiatives like the Fashion Revolution campaign.

Boohoo’s case served as a wake-up call, driving supply chain reforms. While the company has improved labour practices through auditing, transparency, and partnerships, ongoing vigilance is essential to sustain progress anderadicate modern slavery from the industry.

For full details, including all disclaimers applicable to the data contained herein, please refer to the complete article.

1 Global findings | Walk Free

2 Annual profits from forced labour amount to US$ 236 billion, ILO report finds | International Labour Organization

3 Lifting Australian business ambition to combat modern slavery | Australian Anti-Slavery Commissioner

4 Modern Slavery: The true cost of cobalt mining - Human Trafficking Search

5 First Super taps IFM Investors for ESG mandate | FS Sustainability

6 Boohoo ‘facing modern slavery investigation’ after report finds Leicester workers paid as little as £3.50 an hour | The Independent | The Independent

7 Boohoo slavery scandal costs founders £335m | This is Money

8 boohoo-modern-slavery-statement-2023.pdf

9 Boycotting Boohoo: how ethical scandals impact business - The Boar

Related articles

The Private Markets Macro Outlook 2026

Powering a more sustainable future: How renewables can advance the UN SDGs