Infrastructure: From resilience to growth

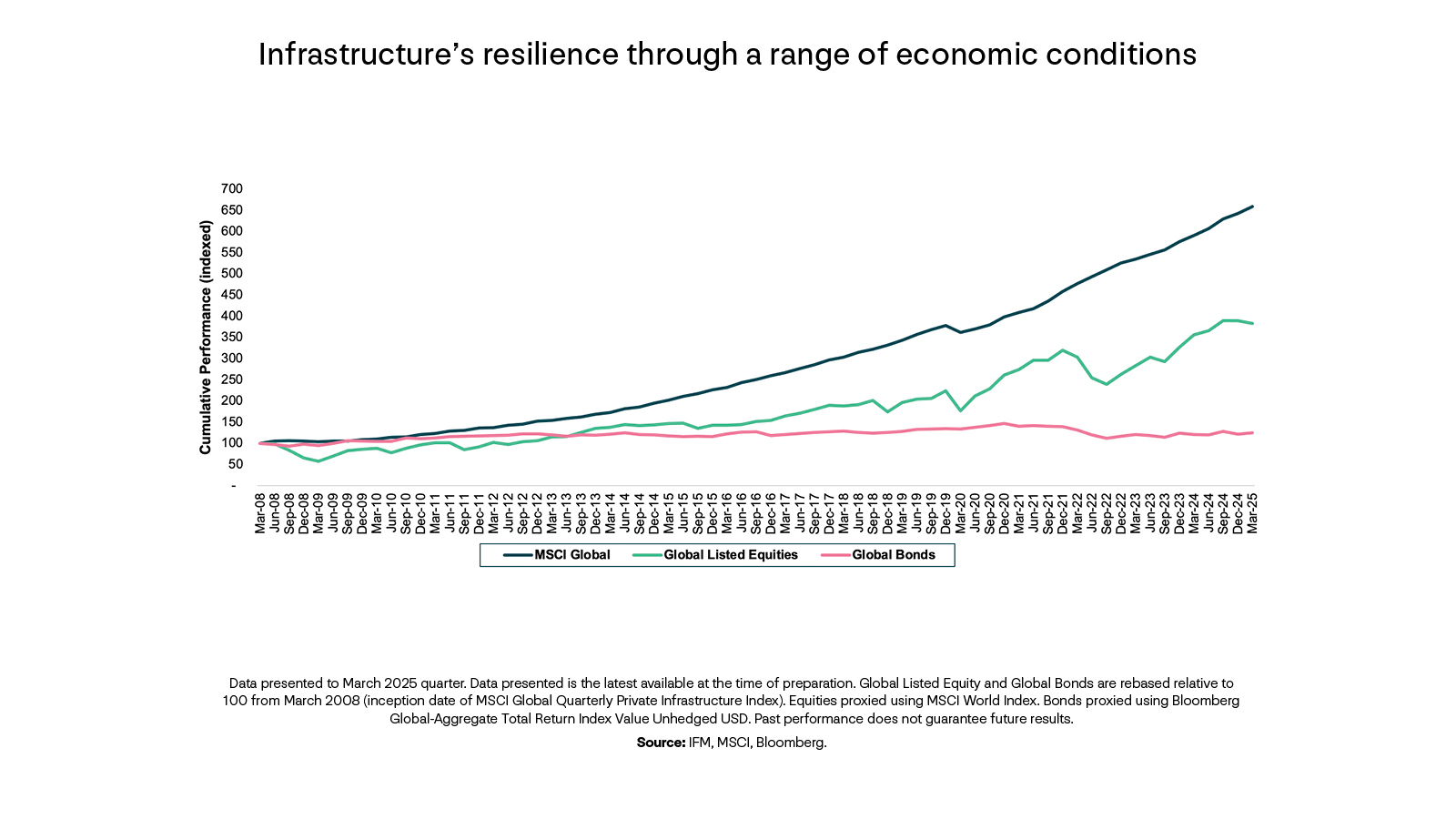

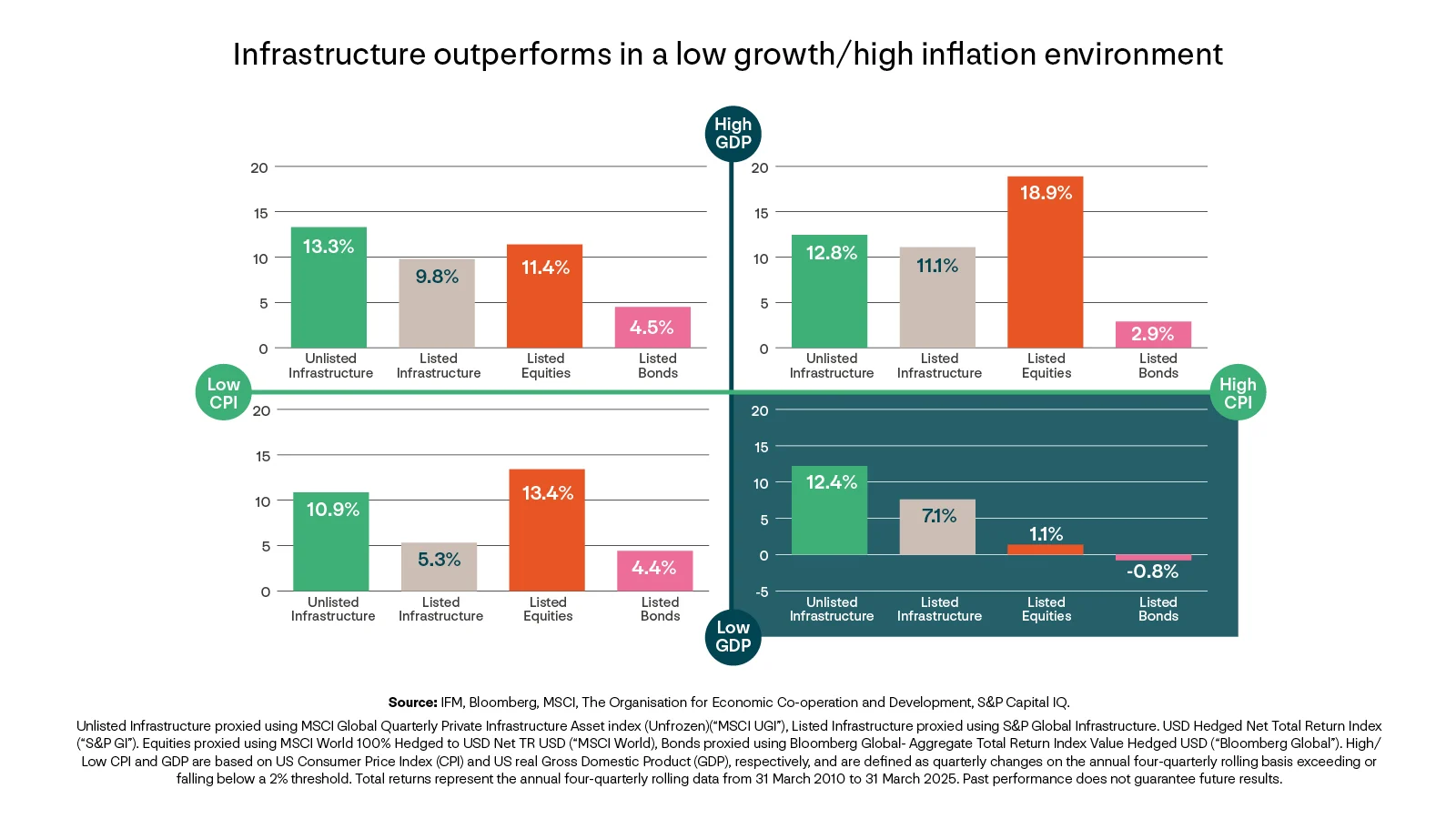

With 60% of institutional investors planning to increase their allocations over the next 3-5 years, infrastructure is evolving from a resilience anchor to a growth engine. From the energy transition to the digital economy, investor demand spans both equity and debt – paving the way for innovative solutions that are global in scope.

*This figure is a projection and is used for illustrative purposes only. Source: IFM, Private Markets 700: The global investor barometer, 2025. Our annual Private Markets 700 report tracks responses from 700+ global institutional investors across 19 countries.

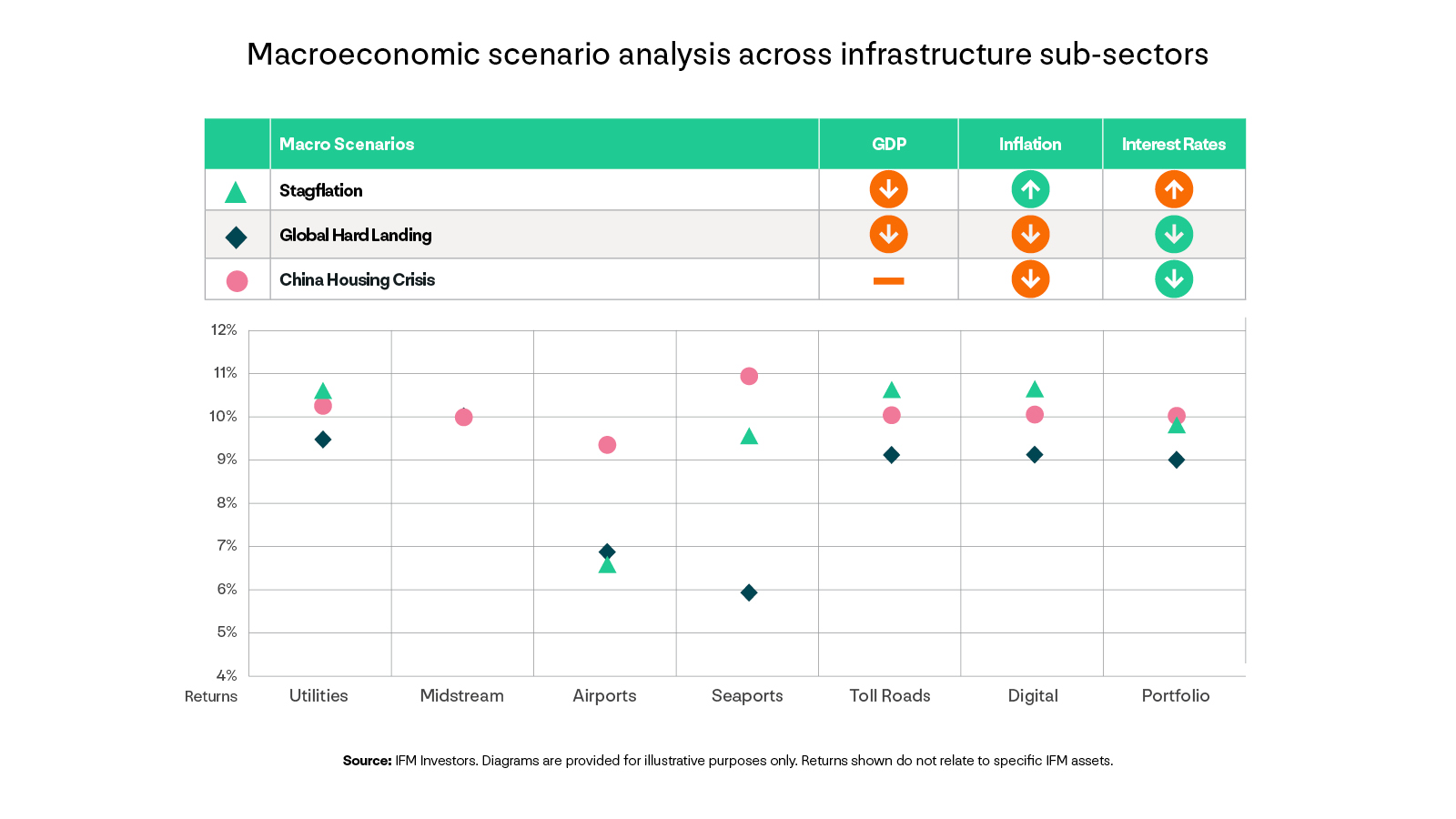

But infrastructure investing is complex…

As the market matures, the way we define infrastructure as an asset class must also evolve to encompass an increasingly diverse set of opportunities. To make something of this – to turn complexity into clarity – requires know-how: a kind of expertise acquired through experience, rather than just theoretical learning.

30-year track record

With a 30-year track record, IFM is one of the largest infrastructure managers in the world. We believe we have the scale, skill and expertise to not only identify opportunities, but build value and meet the needs of future generations.

Long-standing reputation

Our long-standing reputation, and the relationships we’ve fostered accordingly, is what we believe differentiates our approach. Where we invest in assets, our sector experts often sit as board members, with the aim of supporting their success at the highest level. Where we’re financing assets, we're in ongoing dialogue, helping to support the strategic agenda. And where we partner with governments, we see ourselves as key to building and managing critical infrastructure.

IFM Investors is one of the world’s largest and most experienced infrastructure managers.

30+ years

of investing experience

US$92.1bn

infrastructure equity & debt AUM (assets under management)

160+

infrastructure equity and infrastructure debt specialists

90+

board seats at portfolio assets, many with active management

Source: All numbers as at 30 Sep 2025.

Access the 2025 Private Markets 700 research

Private Markets 700 - 2025 research & trends

New research shows institutional investors are asking more from their private markets' allocations – more risk management, higher returns and more sophisticated solutions. Explore the latest private markets trends and strategies, according to 700+ investors.

Related articles

The Private Markets Macro Outlook 2026

Value add infrastructure: Moving up the curve in an era of expanding possibilities

Three reasons to invest in Infrastructure Debt today

Infrastructure: Stable, scalable and in demand

Our approach in action

Digital portfolio

The rise of ‘always on’ connectivity, artificial intelligence (AI), and the digitization of our economy have combined to position digital as one of the fastest growing sub-sectors of infrastructure, as this case study explores.

Indiana Toll Road

As an asset, toll roads are associated with predictable cash flows and stable profitability. And as this case study explores, they may also offer investors a potential hedge against inflation.

Solar portfolio

Sourcing a proprietary transaction can be complex. This case study highlights how fund(s) advised by IFM originated and structured a HoldCo loan with attractive relative value compared to relative liquid corporate indices.

Aleatica

A leading transportation operator, with a focus on the development and operation of toll roads and other mobility assets, can make for an attractive investment, as this case study explores.

Switch, Inc.

With the rise of AI and digitisation, demand for data centers is strong and growing. These assets benefit from steady cashflows and high barriers to entry, as this case study explores.

Offshore energy service operator

The energy transition represents an opportunity, as this debt case study – which focuses on a shipping operator’s pivot towards offshore wind – highlights.

IFM was founded by pension funds. It’s still owned by pension funds today. Our clients are stewards of capital too, with the same goal to deliver value over decades.

Invest in what matters.

From Sydney Airport to the Indiana Toll Road, from energy storage to data storage, we invest in what matters: real assets that will serve society’s needs for decades to come and seek to deliver for clients the positive outcomes they need:

Owned by 16 pension funds

Global presence, with 16 offices including New York and Houston

700+ institutional clients worldwide

460+ institutional clients in US and Canada

Source: All numbers as at 30 Sep 2025.

Come and see us: Meet IFM’s experts at one of our upcoming events.

The 2025 Leaders in Private Markets Forum

Presented by the Canadian Leadership Congress. Discover how investors are building portfolios designed to be more resilient in today's shifting landscape.

iConnections Global Alts Miami 2026

Global Alts Miami gathers investors and managers for specialized capital introductions and in-depth conversations.

Our Infrastructure knowledge hub

We are a pioneer of infrastructure investing. At IFM Investors, our clients benefit from 30 years of infrastructure experience. Over decades, our investment strategy and processes have been tried and tested. Discover our learnings and latest thinking.