Explore the trends defining investor priorities in 2025

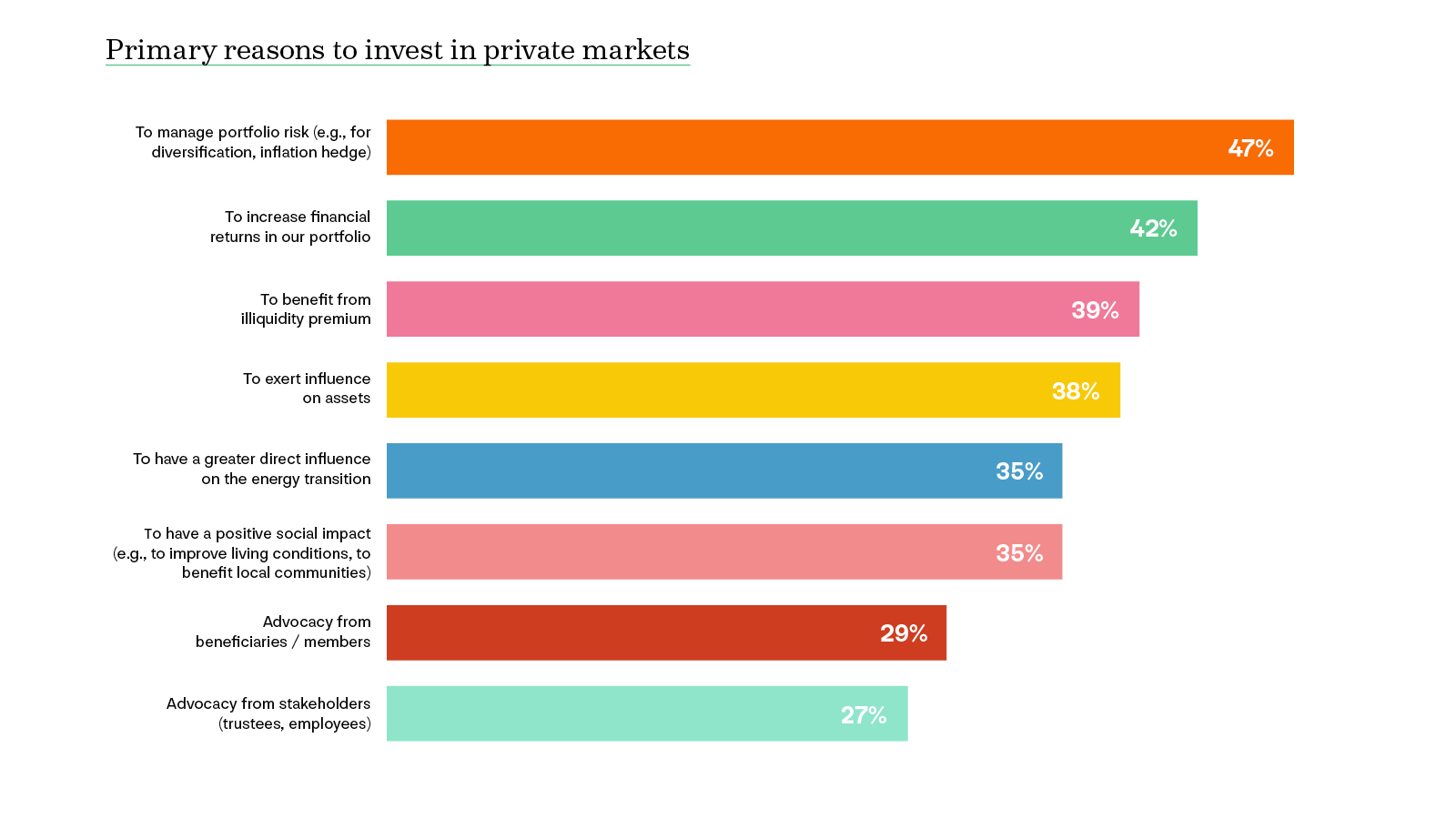

Private markets have moved mainstream and investor expectations are rising. Our research reveals that institutional investors are asking more from their allocations than ever before – more risk management, higher returns and more sophisticated solutions.

33% + Over a third of investor portfolios are allocated to private market investments

Over a third of investor portfolios are allocated to private market investments, with planned allocations rising slightly over the next three to five years. The five major private market asset classes – private debt, unlisted real estate, infrastructure debt and equity, and private equity – continue to be mainstays in institutional investment portfolios.

200 bps Higher net return expectations year-on-year for infrastructure equity

Infrastructure equity net return expectations hit 13.4% in 2025, up 200 basis points (bps) YoY, nearing private equity levels at 13.65%. Infrastructure debt also rose, climbing to net 9.6% (+170bps YoY). We believe private debt continues to appeal due to its expected ability to deliver attractive risk-adjusted returns at just under 10%.

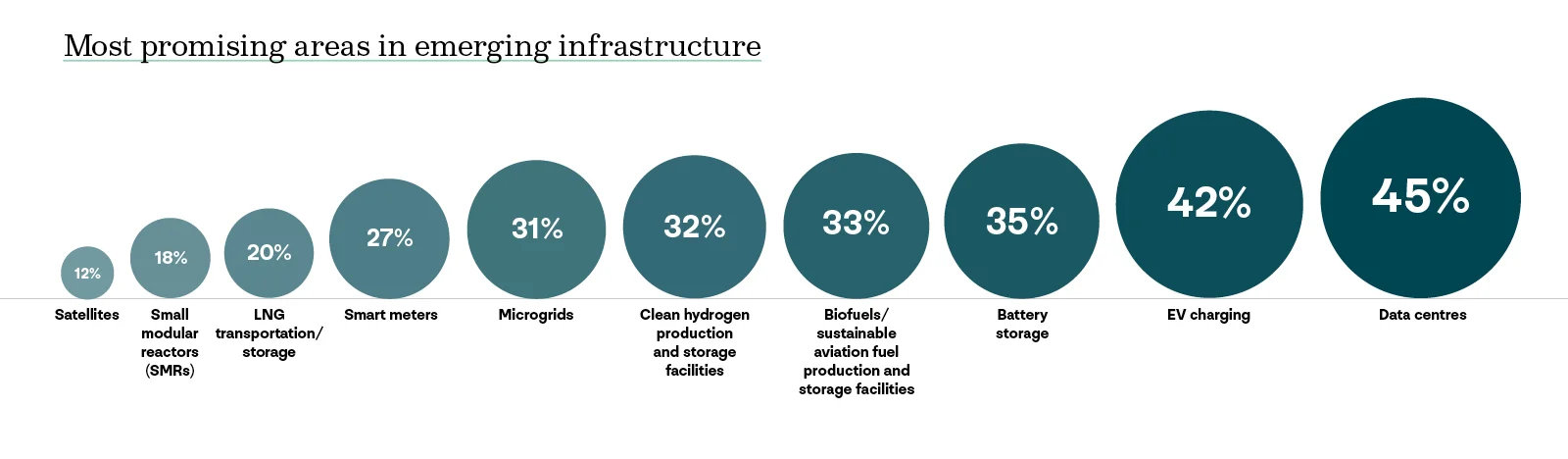

52% Of investors say new technologies and power demand are the top megatrend

More than half of investors view new technologies such as AI, robotics, loT, digitisation and automation and the resulting increased demand for power to support them as the megatrend most impacting allocation decisions. This is followed by increased demand for sustainable and resilient infrastructure (48%).

Key findings from the 2025 Private Markets 700 Research

Investors are embracing more in an era of expanding possibilities in private markets. Use the + icon to discover the themes revealed by the 2025 research.

Diversification redefined

The many roles for private markets

Infrastructure viewed as a growth engine, with defensive qualities

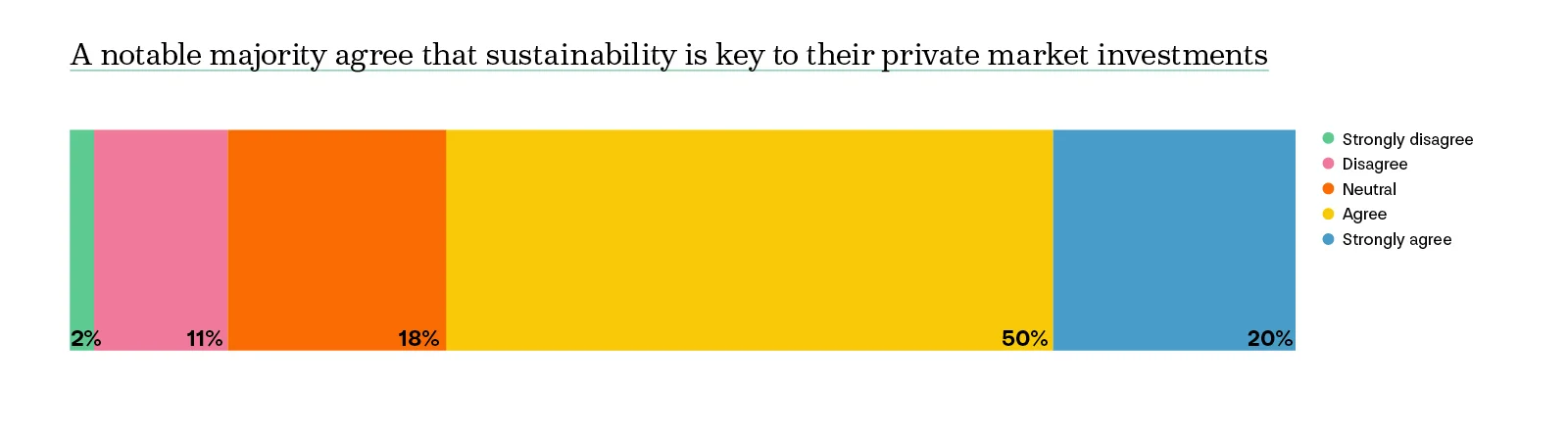

Sustainability stays strong – and performance critical

Appetite is high, deals must follow

Expected net returns from private markets have risen in 2025

Year-on-year return expectations for Private Markets

The Private Markets 700 barometer tracks and compares year-on-year responses from 700+ institutional investors globally. In 2025, private markets are seeing net growth across all asset classes compared to 2024. Investors expect the highest returns from private equity - but infrastructure equity is quickly catching up.

Our latest insights

Value add infrastructure: Moving up the curve in an era of expanding possibilities

PM700 investors display growing hunger for infrastructure assets

Access the 2025 Private Markets 700 research

Read our 2025 Private Markets 700 Research

Investors are asking more from their private markets allocations – more risk management, higher returns and more sophisticated solutions. Explore private markets’ era of expanding possibilities, according to 700+ institutional investors.

Know-how

Learn how IFM can help investors unlock the value of infrastructure investing, turning opportunity into potential outcomes.