Key takeaways |

|

We believe a renewed focus on the reshoring of industries and building economic self-sufficiency will present investment opportunities. |

|

Energy policies and the power generation and transportation landscape are evolving differently in the US and Europe. |

|

Protecting growth drivers such as the digital economy and advanced manufacturing will require increased infrastructure investment, from fibre networks, data centres, factories and logistics to transportation. |

Introduction

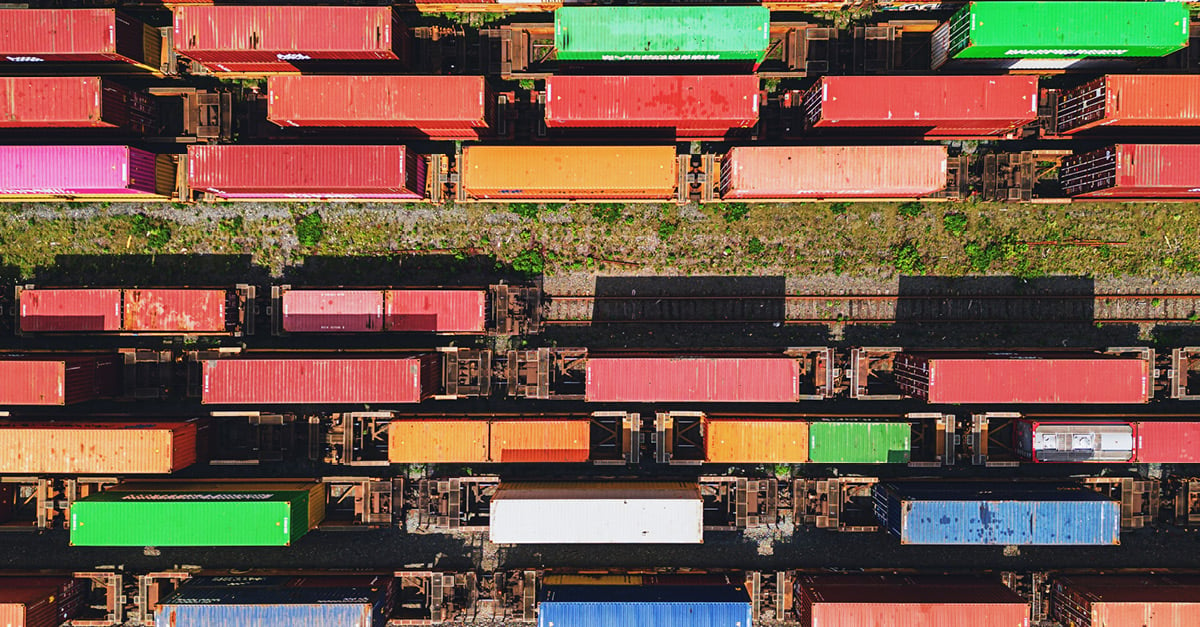

In many ways, the global economy is more deeply interconnected today than at any point in human history. However, deglobalisation has become a popular political talking point, spilling into investor discussions. While we believe the global economy will remain fundamentally interconnected for years

to come, we also believe there will be a renewed focus on reshoring of industries and building national economic self-sufficiency, ultimately impacting the patterns of global trade. These trends are driven by, among other things:

-

Heightened geopolitical tensions

-

Economic nationalism spurred by global competition, the heightened cost of living, immigration concerns, and offshoring

-

Supply chain vulnerabilities

-

Changes in the resource mix needed to power economic growth and resilience

How these movements will shape the next wave of infrastructure investment

Politics and infrastructure have always been heavily intertwined. Support for infrastructure can take many forms and is particularly important for greenfield infrastructure development and growth. A wave of deglobalisation will particularly impact infrastructure investment through:

-

The promotion of energy independence, and

-

Protecting future drivers of growth domestically

These policies will help shape our outlook for debt investing in infrastructure sectors over the coming quarters. In this paper we will consider the landscape in both Europe and the US.

For more, please read the full paper, Deglobalisation’s impact on infrastructure.

This article is part of IFM Investors' 2025 Infrastructure Horizons trends report.

Meet the author

Related articles

Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

Expanding horizons: Infrastructure’s maturing as an asset class demands fresh thinking

AI at a crossroads: How AI is reshaping infrastructure

Integrating ESG analysis into infrastructure debt investments

Flying into the future: Shifting to sustainable aviation fuel sources