Economic Update March 2021

Global economies have come through what appears to be the worst of the COVID-19 crisis, with continued policy support and the roll out of vaccines giving rise to an optimistic outlook. Although concerns around inflation have recently emerged, driving uncertainty in equity and fixed income markets, central banks remain dovish and will likely keep easy policy in place for an extended period.

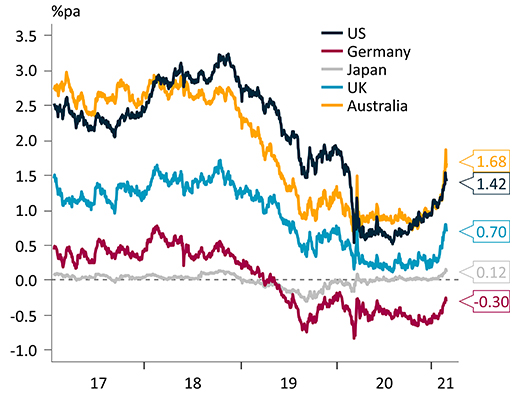

Bond yields are rising as economies recover

Source: IFM Investors, Bloomberg, Macrobond

The recent sell-off in fixed income markets has been relatively sharp, reminiscent of the repricing before the previous global economic upswing in 2016 and the ‘taper tantrum’ of 2013. For economies such as Australia, these trends represent an unwelcome tightening of financial conditions, especially with the Australian dollar rising as a global growth proxy. In the US, this tightening is even more problematic, with rising yields having greater potential to negatively impact real economic activity.

While accommodative policy has prompted economic recovery, little has been done to address the underlying structural issues in advanced economies that have lowered potential growth rates. These include high private and public debt, lack of productivity growth, a dearth of private investment and ongoing demographic challenges. Looking forward, reforms – not fiscal balances – need to become the focus.

Meet the authors

Related articles

Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

Investing in Australia: Accelerating industry super investment and growing Australia’s housing supply