Infrastructure Horizons 2025: How emerging trends in infrastructure will change the world

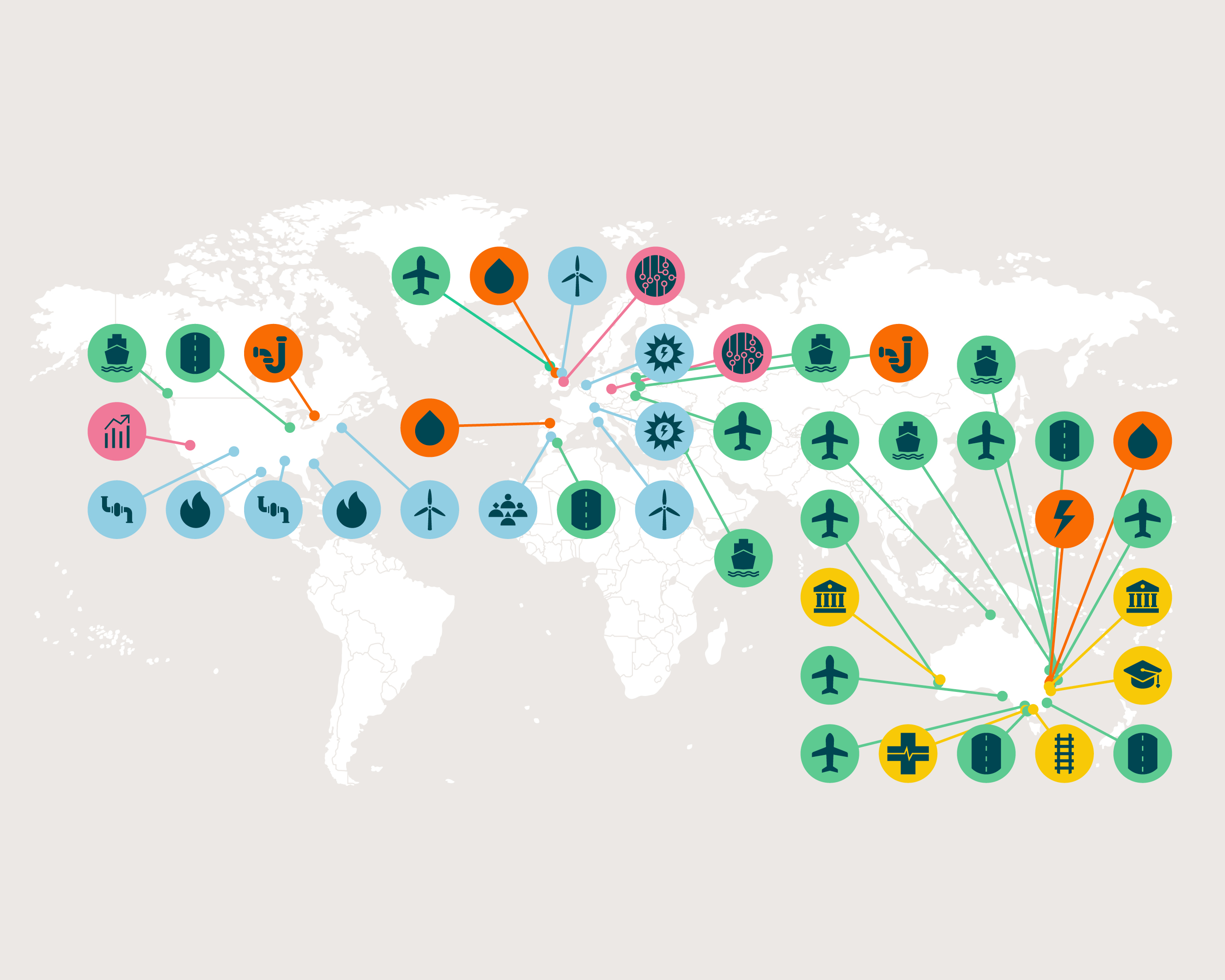

Infrastructure investors are looking at new opportunities in growing areas like artificial intelligence, data centres, renewable natural gas, sustainable aviation fuel and the energy transition, as the asset class continues to mature. Read more in our full report.

Learn more about our Infrastructure Equity Asset Portfolio

We target core infrastructure assets that typically have strong market positions, conservative leverage, predictable regulatory environments and high barriers to entry.

Explore our capabilities

Infrastructure

How we manage our investments in infrastructure has been shaped by decades of experience.

Debt Investments

We offer a range of credit, bond and cash strategies for institutional investors.

Responsible investment

We integrate responsible investment principles into our investment processes and stewardship activities.

Our approach in action

Digital portfolio

The rise of ‘always on’ connectivity, artificial intelligence (AI), and the digitization of our economy have combined to position digital as one of the fastest growing sub-sectors of infrastructure, as this case study explores.

Indiana Toll Road

As an asset, toll roads are associated with predictable cash flows and stable profitability. And as this case study explores, they may also offer investors a potential hedge against inflation.

Aleatica

A leading transportation operator, with a focus on the development and operation of toll roads and other mobility assets, can make for an attractive investment, as this case study explores.

Switch, Inc

With the rise of AI and digitisation, demand for data centers is strong and growing. These assets benefit from steady cashflows and high barriers to entry, as this case study explores.

Offshore energy service operator

The energy transition represents an opportunity, as this debt case study – which focuses on a shipping operator’s pivot towards offshore wind – highlights.

Solar portfolio

Sourcing a proprietary transaction can be complex. This case study highlights how fund(s) advised by IFM originated and structured a HoldCo loan with attractive relative value compared to relative liquid corporate indices.

Contact us

IFM Investors is a global, investor-owned asset manager driven to make a positive difference. We operate from 12 offices, with dedicated Client Solutions teams in cities around the world.