As the global economy recovers from the COVID pandemic, companies and governments are re-thinking how economies operate and focusing on rebuilding in a more sustainable way. Recovery efforts are being supported by ambitious government spending plans that focus strongly on infrastructure. For example, the UK government recently announced £100bn in infrastructure type spending for 2021-22 to help build roads, rail and fibre, amongst other investments, to make the British economy more resilient as part of the ‘Build Back Better’ plan. And this is all taking place alongside the transition toward less carbon intensive infrastructure which we expect to accelerate in the years ahead.

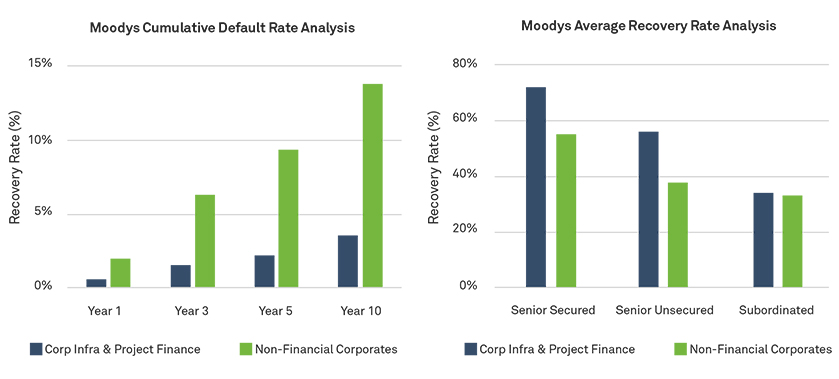

COMPARING DEFAULT AND RECOVERY RATES - INFRASTRUCTURE DEBT VS CORPORATE BONDS

Source: Source: Moody’s Infrastructure Default and Recovery Rates (1983-2019 (published 9 October 2020). Past performance does not guarantee future results.

Since infrastructure financing is often more heavily weighted towards debt than equity, the supply of infrastructure debt opportunities will likely increase in this environment. For investors, the attractiveness of infrastructure debt investments lies primarily in the resilient income they can generate and their relatively low risk profile compared to other similarly yielding fixed income alternatives.

In this paper we outline the case for investing in infrastructure debt, the factors that enable it to provide resilient income and the relative value opportunities that currently exist in the market.

Meet the author

Related articles

Batteries in the energy transition

Value add infrastructure: Moving up the curve in an era of expanding possibilities